Full Length Research Article - (2023) Volume 18, Issue 4

The Impact Of Corporate Governance Mechanisms On Tax Avoidance Practices

Ali A. Ali Bash1* and Faten Zoghlami2*Correspondence: Ali A. Ali Bash, Post-Graduate Institute for Accounting and Financial Studies, University of Baghdad, Iraq & Institute of Higher Commercial Studies in Sousse. Universi, Tunisia, Email:

Abstract

This research came with the aim of showing the impact of governance mechanisms on tax avoidance practices, and in light of this, the financial data of the joint stock companies (industrial, service, agricultural, and hotels) listed in the Iraq Stock Exchange amounting to (35) companies were collected during the period (2009-2020). Through the financial reports published on the market website, multiple linear regression analysis was used as a tool to study the relationship between variables, and (Eviews 12) program was used for analysis and hypothesis testing. To achieve the objectives of the research, (administrative ownership, board size, board independence, women's membership) was adopted as an indicator of the dimensions of governance, and tax avoidance was measured through the effective tax rate. The research concluded that there is a positive impact of administrative ownership and women's membership on tax avoidance practices, as confirmed there is no effect of board size and independence on tax avoidance. The research has reached a set of conclusions, the most important of which are: The method of applying governance mechanisms is one of the main pillars in enhancing competitive capabilities and reorganizing companies' businesses to help them achieve their goals and those of their clients. The research presented a number of recommendations, the most prominent of which were: the necessity of developing a legal and regulatory framework in Iraq that governs the work of joint-stock companies listed within the Iraq Stock Exchange in light of the preparation of principles and mechanisms for governance in a clear and explicit way, to reduce the negative effects and opportunistic practices associated with tax avoidance, and in a manner that is compatible with developments in the financial and legal environment.

Keywords

Administrative ownership. Board size. Board independence. Women membership. Tax avoidance

Introduction

Countries seek through taxes to obtain the largest possible amount of tax revenues to achieve their goals, while companies may resort to reducing tax burdens in order to maximize their value by using all tax avoidance methods (Eskandarlee & Sadri, 2017), ignoring the negative impact on the company in The long term ((Nengzih, 2018). Tax avoidance is a global phenomenon that takes its place in all economic systems, at a time when there is an increasing need to achieve tax compliance in order to increase the revenues needed to finance public expenditures and achieve economic development (Phyllis, 2003). Consequently, studies have increased that search for the factors that affect the company's management decisions regarding tax avoidance. The study (Minnick and Noga, 2010) indicated that the choice of governance and tax avoidance is important because tax avoidance practices may be complex and unclear. It allows administrative exploitation, so understanding the influence that governance mechanisms play in this area is an important process.

Despite the emergence of some studies based on specific countries, some of which focused on financial companies and others on non-financial companies, the results were different. Therefore, the gap in governance studies, and corporate governance in particular, represented the main motive for conducting a study related to the impact of governance mechanisms on tax avoidance. For joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange in the Iraqi environment.

Research problem

It is an attempt to identify the impact of governance mechanisms on tax avoidance practices of joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange.

This problem is crystallized through the following questions:

1. Is there an effect of governance mechanisms on tax avoidance practices from this main question, the following sub-questions branch out:

2. Is there an effect of administrative ownership on tax avoidance practices?

3. Is there an effect of the size of the board of directors on tax avoidance practices?

4. Is there an effect of the independence of the board of directors on tax avoidance practices?

5. Is there an effect of women's membership in the board of directors on tax avoidance practices?

Search target

The main objective of the research is to find out the impact of governance mechanisms on tax avoidance for joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange.

Section one

Theoretical framework

The concept of corporate governance:

With the development of the types of companies and the need to separate ownership from management and the conflict of interests that emerged between shareholders and the board of directors, and in light of the intensification of competition, it was necessary to have a system that regulates the relationship between companies and be a framework for rules and practices that guarantee the ability of the board of directors in accountability, transparency and achieving integrity in the relationship between the company and all parties (management, financiers, customers, society, government), and here the interest in corporate governance emerged as it is a distribution of rights and duties among the various parties, so corporate governance has become one of the important issues raised in the economies of the countries of the world. Corporate governance generally means oversight, management, or the exercise of power and it can be described as good governance at the level of the company.

The International Finance Corporation (IFC) defined governance as: the system through which companies are managed and their business is controlled. The Organization for Economic Co-operation and Development (OECD) defines governance as a set of relationships among those in charge of managing a company, the board of directors, shareholders and other stakeholders. (OECD, 2004).

From the foregoing, we conclude that governance is defined as: a set of principles and mechanisms whose application is intended to achieve protection and justice for all stakeholders. What is meant by corporate governance is the set of rules through which the company is led and directed. It is a control system for a competitive environment in which transparency and accountability are imposed for corporate actions, especially the major ones. The Iraqi legislator did not explicitly explain the concept of corporate governance, but he tried to address it in some texts of national legislation, as it was referred to in some rules and principles of governance. Interest in the concept of corporate governance began. Companies in Iraq in 1985 with the issuance of the Unified Accounting System No. (1), after which a number of laws were issued that regulate the work of companies, including the Iraqi Companies Law No. (21) of 1997 as amended, in addition to the system for practicing the profession of monitoring and auditing No. (3) of 1999 And the Iraqi Stock Exchanges Law No. (74) of (2004).

The concept of tax avoidance:

The tax obligation makes it a burden on the payer and often seeks to avoid it when making his administrative decisions. Despite the importance of taxes in providing a good and stable environment for companies, some companies deal with them as a cost that must be reduced (Ahmed, 2021: 395).

Tax avoidance can be classified into legal and illegal by economists and jurists, due to the difficulty in identifying tax avoidance behavior easily, and that the difference between what is legal and what is illegal in tax administration is very limited so that it is not possible to guarantee the existence of a clear division. Many concepts such as arbitrary tax avoidance, tax administration, tax haven, tax planning, and tax evasion were used to portray the concept of tax avoidance. (Boussaidi, Hamed, 2015: 3), Although the researchers agree that tax avoidance is a set of practices that aim to reduce the amounts of tax paid, it is still a controversial concept that has no agreed upon definition. The tax was defined as the apparent reduction of taxes using a group of methods, such as investing in tax-exempt activities or exploiting some provisions of the law, without reaching the stage of tax evasion. (Khan et al., 2014), as defined as practices aimed at reducing taxable income through tax planning activities, whether those practices are legal, questionable, or even illegal. (Braga, 2017: 409).

We conclude from the foregoing the definition of tax avoidance as (is the reduction in tax payments as a result of the optimal exploitation of legal loopholes to achieve immediate personal interests at the expense of the rest of the stakeholders, and without regard to the possible future effects). Tax avoidance can be divided into two types:

Harmless tax avoidance: It is ethical and legal practices aimed at reducing paid taxes by taking advantage of the established tax law benefits, with comprehensive and honest disclosure of the financial statements.

Harmful tax avoidance: It is expressed in legal and immoral practices that aim to reduce paid taxes by taking advantage of loopholes in the law and twisted interpretations of its texts. (Payne & Raiborn, 2015: 470), As there are many factors that can motivate companies to reduce taxes and resort to avoidance, including weak control mechanisms and governance as well as deficiencies in incentive systems and rewards for managers. Financial, as well as some characteristics of the CEO, such as being characterized by excessive confidence or increased orientation and inclination to take risks. (Kubick & Lockhart, 2017: 729).

Previous studies of corporate governance and tax avoidance

The way in which governance mechanisms are organized affects the company’s fulfillment of its tax obligations, as a result of problems between managers and shareholders due to tax avoidance practices (Sartori, 2008). Tax avoidance for companies is a source of financing, but it is less beneficial for companies that suffer from agency problems and lack of transparency of information. Governance mechanisms can help mitigate the negative effects of tax avoidance (Bayar et al, 2018). Many studies have been concerned with testing the impact of corporate governance on tax avoidance practices. A study (Kiesewetter & Manthey, 2017) examined the relationship between corporate governance and tax avoidance for a sample of German companies. The results indicated that good governance mechanisms reduce tax avoidance practices. The study (Salhi et al., 2019) indicated direct and indirect links between corporate governance and tax avoidance, for a sample of 300 British companies and 200 French companies, and the results revealed that there is a significant impact of corporate governance on tax avoidance.

Contrary to the previous point of view, a study (Kovrmann & Velte, 2019) revealed that corporate governance mechanisms may push companies to increase tax avoidance to improve liquidity in the company. The researcher believes that governance mechanisms play an important role in reducing tax avoidance practices through improving transparency, disclosure and the embodiment of the relationship with stakeholders, from which the first main hypothesis can be derived. There is an impact of governance mechanisms on tax avoidance practices for Iraqi joint-stock companies (industrial, service, agricultural, and hotels) listed on the Iraq Stock Exchange.

The most important studies that linked the dimensions of governance mechanisms and tax avoidance are:

Administrative ownership and tax avoidance

Administrative ownership means that managers and members of the board of directors own part of the company’s shares, which leads to a convergence of interests between managers and shareholders according to the agency theory and then limiting their opportunistic behavior, in addition to the lack of influence on the size of incentives or administrative rewards associated with profits on the decisions of the board of directors ( Endah and Aurora, 2020) The study (Alaa T. Deef et al, 2021) aimed to demonstrate the effect of foreign ownership and management on tax avoidance, for a sample of 69 nonfinancial companies listed on the Egyptian Stock Exchange for the period 2015- 2019, as the results indicated that Administrative ownership has a significant and positive impact on tax avoidance.

The study (Ogbeide & Obaretin, 2018) also found that there is a positive impact of both ownership and management ownership on tax avoidance, for a sample of 85 Nigerian companies for the period 2012-2016. (Barros and Sarmento, 2020) also indicated that there is a positive impact of administrative ownership in reducing tax avoidance practices. However, (Huang and Zhang, 2020/ Ratnawati et.al, 2018/ Park et.al, 2016) indicated that there is an On the other hand, based on the data of financial reports of companies listed on the Indonesia Stock Exchange for the period 2012-2017, a study (Novita & Herliansyan, 2019) revealed However, the institutional ownership and the audit committee have a significant impact on tax avoidance, while the administrative ownership, the independence of the board of directors, and the size of the board have no effect on tax avoidance, as indicated by (Richardson et.al, 2016B/ Jamei, 2017) to the absence of The effect of management ownership on tax avoidance practices, especially in large companies that have multiple branches.

In light of the foregoing, the researcher expects that the administrative ownership will affect the tax avoidance of the Iraqi joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange, which leads the researcher to derive the following hypothesis: There is an effect of the administrative ownership on the tax avoidance practices of the joint-stock companies. Industrial, service, agricultural, and hotels) listed on the Iraq Stock Exchange.

Board size and tax avoidance

The size of the board of directors may be used as a governance mechanism for tax avoidance, in an attempt by board members to reduce taxes paid in a way that is contrary to the purpose of tax regulators (Hoseini et al., 2019; Setayesh et al., 2014). The study (Anggraeni & Kurnianto, 2020, 1127) aimed to demonstrate the effect of board size on tax avoidance for a sample of 114 companies listed on the Indonesia Stock Exchange for the period 2013-2017 by multiple linear regression analysis using the SPSS program, where the results indicated that there is a positive effect of board size on the contrary, (Lanis et.al, 2019/ Khaoula and Moez, 2019/) indicated the negative impact of the size of the board on tax avoidance, and the study (Salhi et al, 2020) was designed to determine the relationship between corporate governance and tax avoidance. For a sample of Japanese and UK companies for the period 2012-2017, the study found that the size of the board of directors reduces the probability of tax avoidance, for tax avoidance in Indonesian companies for the research sample. Whereas (Riguen et.al, 2019/ Novita and Herliansyan, 2019) indicated that there was no effect of the size of the council on tax avoidance.

The researcher found that the size of the board has an impact on tax avoidance in joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange, which leads the researcher to derive the following hypothesis: The size of the board of directors affects the tax avoidance practices of joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange.

Board independence and tax avoidance

The term independent is often defined as free and unbiased and not under the pressure of any of the parties, that is, it is characterized by objectivity and integrity and is not in a position where interests conflict (Murni et al, 2016,80). The board represents the executive management of the company, meaning that the bulk of the members of the board of directors are not executive managers.

Previous studies have varied in determining the impact of the independence of the board of directors on tax avoidance, according to the legal environment, the difference in the sample, and the methodology used. Tax avoidance, on the contrary (Aburajab et al, 2019/ Hoseini et al/ Jamei, 2017) indicated that there is a negative impact of the independence of the board of directors on tax avoidance practices, as the study (Waluyo, 2017) concluded that the independence of the board of directors Management negatively affects tax avoidance, while in the study (Nugroho & Agustia, 2017) the results found during a sample of 92 companies for the period 2013-2016 that there is no effect of the independence of the board of directors on tax avoidance.

Accordingly, the researcher expects that the independence of the board of directors will affect the tax avoidance of joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange, which leads the researcher to derive the following hypothesis: There is an impact of the independence of the board of directors on the tax avoidance practices of joint-stock companies (industrial, services, agricultural, and hotels) listed within the Iraq Stock Exchange.

Women's membership and tax avoidance

The representation of women in the board of directors means that the board of directors of the company adopts the application of gender diversity, which results in the participation of females in the membership of the board. There are two types of representation of women in boards of directors:

a. Compulsory representation of women: It means that there should be a legally minimum number of females within the membership of the board of directors as a condition for the validity of the convening of the councils and then the validity of the decisions issued by them. Excellence in all its civil rights (Thams et al, 2018).

b. Voluntary representation of women: It means selecting females for membership in the board of directors on a voluntary basis based on their qualifications without the existence of a legal justification. As an organization that supports diversity and equality. (Manyaga & Taha, 2020), The representation of women on the boards of directors of companies aims to achieve diversity in viewpoints on the various decisions of the company’s board of directors, and then to reach the best options that enhance the position of the company and preserve the rights of shareholders (Muhammad, 2020: 8), Dakhli’s study showed, 2021:4)) that the personal characteristics of the female component are characterized by being more risk-averse, and this is evident in their tendency towards less risky decisions.

The study of (Hoseini and Gerayli 2018: 53) revealed that the representation of women on the company’s board of directors positively affects the inclination of executives to adopt tax avoidance policies, and the study (Hoseini et al., 2019:203) showed the importance of the role of women’s representation on the board of directors. Management to reduce tax avoidance practices, due to being the most capable in containing the opportunistic behavior of executives to implement tax avoidance activities. On the contrary, (Lanis et al, 2019; Riguen et al, 2019) indicated that there is a negative impact of the percentage of women's representation in reducing tax avoidance practices. While (Suleiman, 2020,: 190; Zemzem & Ftouhi, 2013) indicated that there was no significant effect of women's representation on boards of directors on tax avoidance practices.

Accordingly, the researcher expects that the participation of women in the board of directors will affect the tax avoidance of joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange, which leads the researcher to derive the following hypothesis: There is an impact of the membership of women in the board of directors on the tax avoidance practices of joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange.

Section two

Method and Procedures

The research methodology and procedures are one of the main axes through which the applied side is accomplished, as it provides an opportunity to obtain the necessary data to conduct the statistical analysis in order to reach and interpret the results, and thus strive to achieve the objectives of the study.

Research methodology

Based on the nature of the study and in order to reach the goals it aims for, the study used the descriptive and deductive approach, which works by studying the phenomena as they are on the ground with an indication of the existence of a correlation between the variables or not, by using multiple linear regression, as well as being one of the methods that describe Accurate and quantitative, as this approach does not depend on collecting information related to the phenomenon, but rather goes beyond it to analysis and extracting the effects that are related to the phenomenon, in order to reach the interpretations and results through which the researcher builds his perceptions of the study proposal, and based on the main objective, which is centered in an impact statement. Governance mechanisms for tax avoidance of the joint-stock companies, the study sample. The descriptive approach was adopted by analyzing the financial statements of the joint-stock companies listed within the Iraq Stock Exchange for the period (2009-2020).

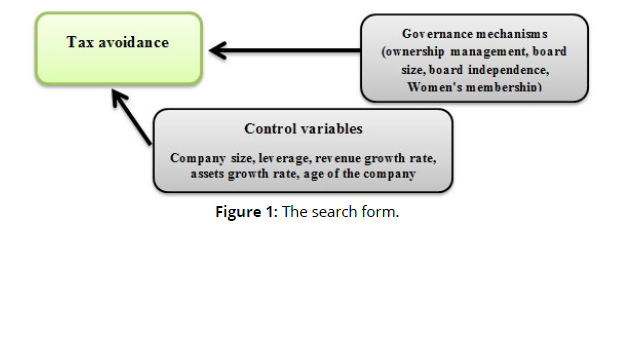

Research form

Figure No. (1) shows the research model that shows a set of independent variables represented by governance mechanisms that are expected to have an impact on tax avoidance for joint-stock companies listed on the Iraq Stock Exchange (Figure 1).

Search variables

The search variables included the following:

a. Governance mechanisms, including (administrative ownership, board size, board independence, women's membership in the board of directors).

b. It also included the dependent variable: tax avoidance.

c. The research also included the following regulatory variables: (company size, financial leverage, revenue growth rate, assets growth rate, age of the company).

Methods for measuring research variables

The research variables were measured based on the researchers as follows:

a. Administrative ownership: the number of shares owned by the executive management and members of the board of directors to the total number of traded shares of the company (Salaudeen & Ejeh, 2018; Novita & Herliansyan, 2019).

b. Board size: the natural logarithm of the number of board members. (Hoseini et al, 2019; Jabbar et al, 2021).

c. Board independence: the ratio of independent members of the board of directors to the total members (Aburajab et al, 2019; Novita & Herliansyan, 2019).

d. Women’s membership: a binary variable that takes (1) in the event that there is representation of women on the board of directors or that they are delegated directors in which the opposite is taken (Ali & Atsh, 2021).

e. Tax avoidance: measured by:

- Effective tax rate = cash taxes paid / net profit before taxes (Firmansyah and Muliana, 2018; Bimo et al, 2019; Sugiyanto et al, 2020).

- Firm Size: Natural Log of Firm Total Assets (Gan, 2019; Yahaya & Yusuf, 2020).

- Leverage: equal to total liabilities/total assets (Richardson et al, 2016; Sugiyanto et al, 2020).

- Sales growth ratio: ((sales of the current year - sales of the previous year) / sales of the previous year). (Kadhim & Hasan, 2020).

- Assets growth rate: ((Total assets of the current year - Total assets of the previous year) / Total assets of the previous year). (Dube, 2018).

- Age of the company: equal to the current year - the year of establishment (KANAKRIYAH, 2021: 435).

Research hypothesis

The main hypothesis: There is an impact of governance mechanisms on tax avoidance practices, from which the following hypotheses branch out:

The first sub-hypothesis: There is an effect of administrative ownership on tax avoidance practices.

The second sub-hypothesis: There is an effect of council size on tax avoidance practices

The third sub-hypothesis: There is an effect of the council's independence on tax avoidance practices.

The fourth sub-hypothesis: There is an effect of women's membership in the board of directors on tax avoidance practices.

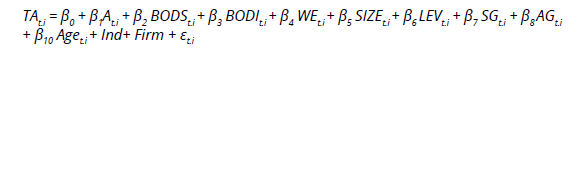

Hypothesis test form

For the purpose of testing the main hypothesis, the model is used:

It is represented by:

TA (t.i): Tax avoidance: It is measured by the effective tax rate which is equal to cash taxes paid

CA (t.i): Administrative Ownership Ratio: The number of shares owned by the executive management and members of the Board of Directors over the total shares.

BODS (t.i): Board Size: Natural logarithm of the number of board members.

BODI (t.i): Independence: The ratio of the independent members of the Board of Directors to the total members.

WE (t.i): Women’s membership: a binary variable that takes (1) in the event that there is representation of women on the board of directors or that she is an authorized director in it, otherwise it takes (0).

SIZE (t.i): Company size: It represents the natural logarithm of the company's assets.

LEV (t.i): Leverage: equal to total liabilities/total assets.

SG (t.i): Sales growth rate: ((current year sales - previous year sales) / previous year sales).

AG (t.i): Assets growth rate: ((Total assets of the current year - Total assets of the previous year) _ Total assets of the previous year).

Age (t.i): The age of the company: equal to the current year – year of incorporation.

Ind: the effect of workmanship.

Firm: Firm effect.

Ε (t.i): error value (residuals).

Study population and sample

The study population includes all joint-stock companies (industrial, service, agricultural, and hotels) listed within the Iraq Stock Exchange for the period 2009-2020, which are (35) companies.

Descriptive and statistical analysis and hypothesis testing

Descriptive statistics for all research variables

Descriptive statistics of all variables during the study period extending from the year (2009) to the year (2020). Table No. (1) Below is dedicated to presenting the arithmetic mean, median, standard deviation, and upper and lower limits for the study variables, as follows: (Table 1)

| Variable | Mean | Maximum | Minimum | Std. Dev. |

|---|---|---|---|---|

| TA | 0.120 | 0.531 | -0.596 | 0.044 |

| CA | 0.174 | 0.992 | 0.000 | 0.077 |

| BODS | 1.906 | 2.485 | 1.609 | 0.053 |

| BODI | 0.906 | 1.000 | 0.571 | 0.035 |

| We | 0.401 | 1.000 | 0.000 | 0.200 |

| SIZE | 22.352 | 26.895 | 18.996 | 0.270 |

| LEV | 0.553 | 19.782 | 0.002 | 1.070 |

| SG | 12.317 | 6403.356 | -2232.125 | 342.590 |

| AG | 0.113 | 8.198 | -1.000 | 0.488 |

| AGE | 3.388 | 4.304 | 2.079 | 0.042 |

It was found that the lowest value of the administrative property amounted to (0.000), while the highest value amounted to (0.992), with an arithmetic mean of (0.174) and a standard deviation of (0.077). As for the size of the Board of Directors, it was found that the lowest value amounted to (1.609), while the highest value amounted to (2.485), with an arithmetic mean of (1.906) and a standard deviation of (0.053). Regarding the independence of the Board,it was found that the lowest value amounted to (0.571). ), while the highest value amounted to (1.000), with an arithmetic mean of (0.906) and a standard deviation of (0.035). Regarding women’s membership in the Board of Directors, it was found that the lowest value for women’s participation amounted to (0.000), while the highest value amounted to (1.000), with an arithmetic mean of (0.401), and a standard deviation of (0.200).

As for tax avoidance, it was found that the lowest value amounted to (-0.596), while the highest value amounted to (0.531), with arithmetic mean of (0.120) and a standard deviation of (0.044).

Test the correlation coefficient between the variables of the study

The correlation coefficient measures the degree of linear correlation between two variables, and the correlation coefficients for the study variables were as in the table below: (Table 2)

| Correlation | TA1 | CA | BODS | BODI | WE | SIZE | LEV | SG | AG | AGE |

|---|---|---|---|---|---|---|---|---|---|---|

| TA1 | 1.000 | |||||||||

| Probability | ----- | |||||||||

| CA | 0.026 | 1.000 | ||||||||

| Probability | 0.761 | ----- | ||||||||

| BODS | -0.038 | 0.107 | 1.000 | |||||||

| Probability | 0.654 | 0.209 | ----- | |||||||

| BODI | -0.049 | 0.112 | 0.681 | 1.000 | ||||||

| Probability | 0.569 | 0.188 | 0.000 | ----- | ||||||

| WE | 0.096 | 0.006 | 0.121 | -0.029 | 1.000 | |||||

| Probability | 0.258 | 0.943 | 0.155 | 0.737 | ----- | |||||

| SIZE | -0.035 | 0.306 | 0.461 | 0.550 | -0.259 | 1.000 | ||||

| Probability | 0.684 | 0.000 | 0.000 | 0.000 | 0.002 | ----- | ||||

| LEV | 0.160 | -0.175 | -0.042 | 0.132 | -0.068 | -0.098 | 1.000 | |||

| Probability | 0.059 | 0.038 | 0.623 | 0.121 | 0.424 | 0.251 | ----- | |||

| SG | -0.048 | -0.108 | 0.081 | 0.127 | 0.051 | 0.034 | 0.132 | 1.000 | ||

| Probability | 0.577 | 0.205 | 0.343 | 0.136 | 0.553 | 0.688 | 0.121 | ----- | ||

| AG | 0.082 | -0.076 | -0.063 | -0.028 | 0.043 | -0.024 | 0.277 | 0.609 | 1.000 | |

| Probability | 0.338 | 0.374 | 0.460 | 0.746 | 0.617 | 0.782 | 0.001 | 0.000 | ----- | |

| AGE | -0.096 | -0.150 | -0.089 | -0.105 | 0.331 | 0.030 | -0.038 | 0.051 | 0.177 | 1.000 |

| Probability | 0.260 | 0.077 | 0.294 | 0.219 | 0.000 | 0.726 | 0.653 | 0.547 | 0.036 | ----- |

It is noted that the values of the correlation coefficient between the independent variables in the above table are less than (0.80 ±), which indicates that there is no problem of the linear correlation between the independent variables.

Hypothesis test

The study sample included 35 companies located within four sectors (services, industry, hotels and tourism, agriculture) within the Iraq Stock Exchange during the period (2009-2020), and the data was collected through the financial statements published on the website of the Iraq Stock Exchange. Multiple linear regression analysis was used to test the hypotheses of the study.

The main hypothesis: the impact of corporate governance mechanisms on tax avoidance, from which the following hypotheses branch out:

a. There is an effect of administrative ownership on tax avoidance.

b. There is an impact of the size of the board of directors on tax avoidance.

c. There is an impact of the independence of the board of directors on tax avoidance.

d. There is an effect of women's membership in the board of directors on tax avoidance. (Table 3)

Variable |

Coefficient | Std. Error | t-Statistic | Prob. | Contrast magnification coefficient VIF |

|---|---|---|---|---|---|

| C | -1.030 | 1.147 | -0.898 | 0.372 | |

| CA | 0.039 | 0.013 | 3.078 | 0.003 | 2.303 |

| BODS | -0.022 | 0.014 | -1.510 | 0.135 | 2.229 |

| BODI | 0.038 | 0.040 | 0.963 | 0.338 | 2.557 |

| WE | 0.010 | 0.005 | 2.000 | 0.049 | 1.388 |

| SIZE | -0.001 | 0.003 | -0.360 | 0.720 | 3.470 |

| LEV | 0.064 | 0.012 | 5.440 | 0.000 | 1.208 |

| SG | -0.001 | 0.002 | -0.699 | 0.486 | 1.032 |

| AG | 0.003 | 0.005 | 0.596 | 0.553 | 1.044 |

| AGE | -0.007 | 0.005 | -1.435 | 0.155 | 1.443 |

| R-squared | 0.788 | Adjusted R-squared | 0.759 | ||

| F-statistic | 15.403 | Prob(F-statistic) | 0.000 | ||

| Durbin-Watson | 1.760 | ||||

Table No. (3) shows, through the extracted results of the statistical analysis, the significance of the model, where the value of (Prob) (F-statistic) was less than (0.05) and it was (0.000). This indicates that the model is valid for testing and that its results are dependable. (Durbin-Watson) amounted to (1.760), which is greater than the value of (R-squared), which amounted to (79%), and this explains the lack of autocorrelation and false regression. As for the value of (R-squared), it amounted to (0.788), meaning that the explanatory power For the independent variables in the dependent variable is 79%), while for the value of (Adjusted R-squared) it amounted to (0.759), which indicates that the percentage of the influence of the independent variables in the dependent variable is 76%), and the remaining (24%) is due to other factors outside the model. We note from the above table that the values of the variance inflation coefficient (VIF) are all less than (10), which indicates that there is no problem of the collinearity of the independent variables between them, which is specific to the second model.

The effect of administrative ownership percentage on tax avoidance

The results of the statistical analysis show that the value (Prob) of the independent variable corporate governance (the percentage of administrative ownership) is less than (0.05), as it amounted to (0.003), and this indicates that there is a direct significant effect of administrative ownership on tax avoidance, and this study agrees with the study (Alaa T. Deef et al, 2021; Ogbeide & Obaretin, 2018; Barros and Sarmento, 2020), which means accepting the hypothesis that (there is an effect of the administrative ownership ratio on tax avoidance), meaning that a decrease in the administrative ownership ratio may prompt the administration to adopt Policies that reduce tax avoidance and avoid tax violations that harm the company's reputation and market value.

The effect of board size on tax avoidance

The results of the statistical analysis show that the value (Prob) of the independent variable corporate governance (board size) is higher than (0.05), it reached (0.135), and this indicates that there is no significant effect of the board size on tax avoidance, and this study is consistent with Riguen's study et.al, 2019/ Kadir, 2018/ Novita and (Herliansyan, 2019) This means rejecting the hypothesis that states (there is an effect of the size of the board of directors on tax avoidance).

The effect of the independence of the board of directors on tax avoidance

The results of the statistical analysis show that the value of (Prob) for the independent variable corporate governance (independence of the board of directors) is higher than (0.05), it reached (0.338), and this indicates that there is no significant effect of the independence of the board on tax avoidance, and this study agrees with the study of ( Nugroho & Agustia, 2017) This means rejecting the hypothesis that states (the effect of the independence of the board of directors on tax avoidance).

The impact of women's membership in the board of directors on tax avoidance

The results of the statistical analysis show that the value of (Prob) for the independent variable corporate governance (women's membership) is less than (0.05), reaching (0.049), and this indicates that there is a significant effect of women's participation on tax avoidance. This may be due to the low representation of women in the board of directors, which cannot influence the company's decisions, including those related to tax avoidance. This study is consistent with the study of (Lanis et al, 2019; Riguen et al, 2019).This means accepting the hypothesis that (the effect of women's participation in the board of directors on tax avoidance).

Results

The Iraqi legislator has touched on the concepts and mechanisms of governance without explicitly adopting the concept of corporate governance, nor has he explicitly referred to the representation of women on the board of directors. By providing a comprehensive description of the variables of the study using descriptive statistics represented by the arithmetic mean, standard deviation, upper and lower values, and checking the suitability of the data for statistical analysis, the results revealed that there is no problem in the linear correlation between the independent variables. It is stable over time, and the study hypotheses were subjected to multiple regression analysis using the (EViews12) software in order to test them. The results indicated the following:

1. The method of applying governance mechanisms is one of the main pillars in enhancing competitive capabilities and reorganizing companies’ businesses to help them achieve their goals and those of their clients, and that the shortcomings in the legal and regulatory framework that governs Iraqi joint-stock companies in applying governance makes it difficult to establish general principles and standards for governance.

2. Accepting the first and fourth sub-hypotheses related to the impact of each of the administrative ownership and the membership of women in the board of directors on tax avoidance, and the second and third sub-hypotheses related to the impact of each of the size and independence of the board on tax avoidance were rejected.

3. The results of the descriptive statistic of tax avoidance for the study sample companies, which was measured through the actual tax rate, showed a decrease in the arithmetic average for all companies, reaching (0.12) from the legal tax rate of (0.15), which means that most companies tend to practice tax avoidance, the more The measure of tax avoidance continued to decrease as the rate of tax avoidance increased with it.

4. The results of the descriptive analysis of the mechanisms of governance showed that there is a discrepancy between the Iraqi shareholding companies with regard to the percentage of administrative ownership of the members of the board of directors, and the existence of a relative convergence between companies in the size of the board of directors and independence, in addition to the existence of a discrepancy between companies in the membership of women in the board of directors.

Recommendations

1. The need to establish a legal and regulatory framework in Iraq that governs the work of joint-stock companies in Iraq in the light of preparing clear and explicit principles and mechanisms for governance. To reduce the negative effects and opportunistic practices associated with tax avoidance activities, which are reflected in improving the performance of companies, and in a manner that is consistent with developments in the financial and legal environment.

2. Despite the positive relationship in the study between women's membership and tax avoidance, which may be due to several reasons, including the low level of representation of women in the board of directors, the Iraqi shareholding companies should be encouraged to attract qualified women in the membership of the board, and that the presence of women is not Symbolically, but based on her experience and qualifications to achieve the desired benefit from diversity.

3. Paying attention to the idea of board diversity and women’s representation in the boards of directors of joint-stock companies within the framework of socially equitable governance, to add diversity and expansion of ideas and points of view when convening board meetings, and in order to protect women’s gains in assuming leadership roles in those companies.

4. Training tax staff on the methods used by companies in the practice of tax avoidance and methods of fraud detection in light of creative accounting practices, and in return deepening the thought and culture of governance in the human element of companies and training them to raise the level of their skills, as the human element is one of the basic pillars for improving performance, whether for the company or the tax administration.

References

Aburajab Luai, Bassam Maali, Monther Jaradat, & Malek Alsharairi. (2019) Board of directors’ characteristics and tax aggressiveness: Evidence from Jordanian listed firms. Theoretical Economics Letters 9(7), 2732-2745. https://doi.org/10.4236/tel.2019.97171

Awad Ahmed. (2021). Corporate Social Responsibility and Tax Avoidance: Egypt Evidence. Arab Journal of Administration, 41(4), 395-406. https://doi.org/10.21608/aja.2021.205201

Deef Alaa T, Badi Alrawashdeh, & Nawwaf Al-fawaerh. (2021). The impact of foreign ownership and managerial ownership on tax avoidance: empirical evidence from Egypt. Academy of Accounting and Financial Studies Journal, 25(2), 1-13.

Ali Ibrahim Zakaria Arafat, & Atsh Abdo Ahmed Abdo. (2021). The impact of women's participation in the board of directors on its effectiveness in achieving the goals of corporate governance (an applied study in the Egyptian business environment). Journal of Contemporary Business Studies, Faculty of Commerce, Kafr El-Sheikh University, Egypt, 7(11).

Anggraeni D. P., & Sigit Kurnianto. (2020). The effect of board size and female directors on tax avoidance. International Journal of Innovation, Creativity and Change, 13(8), 1127-1141.

Barros, Victor, & Joaquim Miranda Sarmento. (2020). Board Meeting Attendance and Corporate Tax Avoidance: Evidence from the UK. Business Perspectives and Research, 8(1), 51-66. https://doi.org/10.1177/2278533719860021

Bayar Onur, Fariz Huseynov, & Sabuhi Sardarli. (2018). Corporate Governance, Tax Avoidance, and Financial Constraints. Financial Management, 47(3), 651-677.https://doi.org/10.1111/fima.12208

Bimo Irenius Dwinanto, Christianus Yudi Prasetyo, & Caecilia Atmini Susilandari. (2019). The effect of internal control on tax avoidance: the case of Indonesia. Journal of Economics and Development, 21(2), 131-143. https://doi.org/10.1108/JED-10-2019-0042

Boussaidi Ahmed, & Mounira Sidhom Hamed. (2015). The empact of governance mechanisms on tax aggressiveness: empirical evidence from Tunisian context. Journal of Asian business strategy, 5(1).

Braga Renata Nogueira. (2017). Effects of IFRS adoption on tax avoidance. Revista Contabilidade & Finanças, 28, 407-424. https://doi.org/10.1590/1808-057x201704680

Dakhli Anissa. (2021). Do women on corporate boardrooms have an impact on tax avoidance? The mediating role of corporate social responsibility. Corporate Governance: The international journal of business in society, 22(4), 821-845. https://doi.org/10.1108/CG-07-2021-0265

Dube Tapiwa. (2018). An Analysis of Effects of Ownership on Capital Structure and Corporate Performance of South African Firms. South Africa: Faculty of Economic and Management Sciences, University of Pretoria, Ph.D thesis. http://hdl.handle.net/2263/67994

Eddy Endah Purnama Sari, & Aurora Angela. (2020). The Impact Analysis of Return on Asset, Leverage and Firm Size to Tax Avoidance. Jurnal Akuntansi, 12(2), 256-264. https://doi.org/10.28932/jam.v12i2.2908

Eskandarlee Taher, & Taj Mohammad Sadri. (2017). Impact of management ability on relationship between tax avoidance and firm value in companies listed in tehran stock exchange. QUID: Investigación, Ciencia y Tecnología 1, 1859-1868. https://dialnet.unirioja.es/servlet/articulo?codigo=6223042

Firmansyah Amrie, & Rizka Muliana. (2018). The Effect of Tax Avoidance and Tax Risk on Corporate Risk. Jurnal Keuangan dan Perbankan 22(4), 643-656. https://doi.org/10.26905/jkdp.v22i4.2237

Gan Huiqi. (2019). Does CEO managerial ability matter?, Evidence from corporate investment efficiency. Review of Quantitative Finance and Accounting, 52(4), 1085-1118. https://doi.org/10.1007/s11156-018-0737-2

Hoseini, M., and Gerayli, M. (2018), ‘The Presence of Women on the Board and Tax Avoidance: Evidence from Tehran Stock Exchange’, International Journal of Finance and Managerial Accounting, Vol.3, No.9, pp. 53-62

Hoseini, M., Gerayli, M. and Valiyan, H. (2019), “Demographic characteristics of the board of directors’ structure and tax avoidance”, International Journal of Social Economics, Vol. 46, No. 2, pp. 199-212, doi:10.1108/IJSE-11-2017-0507.

Huang, H. and Zhang, W., (2020). Financial expertise and corporate tax avoidance. Asia-Pacific Journal of Accounting & Economics, 27(3), pp.312-326

Jabbar, A. Kh., Hasan, H. F., & Khalbas, H. N. (2021). A study of the market reaction to CEO change.Economic Annals-XXI, 187(1-2), 206-214. doi: https://doi.org/10.21003/ea.V187-20

Jamei, R., (2017). Tax Avoidance and Corporate Governance Mechanisms: Evidence from Tehran Stock Exchange. International Journal of Economics and Financial Issues, 7(4), Pp. 638-644.

Kadhim, Salah Chyad, Hasan, Hussein Falah,(2020). The Effect of Business Diversity on the Relation between Profit Sustainability, Real Earnings Management and Commercial Credit in Companies of Securities and Exchange Organization of Iraq, Industrial Engineering & Management Systems Vol 19, No 4, pp.908-915.

KANAKRIYAH, Raed,(2021). The Impact of Board of Directors’ Characteristics on Firm Performance:A Case Study in Jordan, Journal of Asian Finance, Economics and Business Vol 8 No 3 (2021) 0341–0350.

Khan, M., Youssef and Khan, Z., Yasir, M., (2014), Analysis of the Relationship between CSR and Tax Avoidance: An Evidence from Pakistan, the International of Business and management, vol 2, Issue 7: 53-57

Khaoula, F. and Moez, D., (2019). The moderating effect of the board of directors on firm value and tax planning: Evidence from European listed firms. Borsa Istanbul Review, 19(4), pp.331-343

Kiesewetter, D., and M.Manthey, (2017), The relationship between corporate governance and tax avoidance - evidence from Germany using a regression discontinuity design, arqus Discussion Paper, No. 218, Arbeitskreis Quantitative Steuerlehre (arqus), Berlin, available at: http://hdl.handle.net/10419/157955

Kovermann, J., and P.Velte, (2019), The impact of corporate governance on corporate tax avoidance-A literature review, Available at: https://www.sciencedirect.com/science/article/abs/pii/S1061951818301071.

Kubick, T., & G. Lockhart, (2017). Overconfidence, CEO Awards, and Corporate Tax Aggressiveness, Journal Of Business Finance and Accounting, & 44 (5) & (6): 728- 754

Lanis, R., Richardson, G., Liu, C. and McClure, R., (2019). The impact of corporate tax avoidance on board of directors and CEO reputation. Journal of Business Ethics, 160(2), pp.463-498

Manyaga, F. & Taha, A. (2020). Linking firm performance with board diversity: A literature review. Bussecon Review of Finance & Banking (2687-2501), 2, 10-18

Minnick, K. and T. Noga. (2010). Do corporate governance characteristics influence tax management?. Journal of Corporate Finance16:703-718.

Nengzih (2018). Determinants of Corporate Tax Avoidance: Survey on Indonesia’s Public Listed Company. International Journal of Economics, Business and Management Research 2(2):133-145.

Novita, E.S., and Y.Herliansyah, (2019), The Effect of Corporate Governance Mechanism, Liquidity and Company Size on Tax Avoidance, Saudi Journal of Economics and Finance, 3 (9): 366-373.

Nugroho, W.C., and D.Agustia, (2017), Corporate Governance, Tax Avoidance, and Firm Value, Available at: http://afebi.org/journal/index.php/aar/article/view/87.

OECD, OECD principles of corporate Governance ,OECD Publications Service, Paris, France, 2004

Ogbeide, S.O., and O.Obaretin, (2018), Corporate Governance Mechanisms and Tax Aggressiveness of Listed Firms in Nigeria, Amity Journal of Corporate Governance, 3 (1): 1-12.

Park, J., Ko, C.Y., Jung, H. and Lee, Y.S., (2016). Managerial ability and tax avoidance: evidence from Korea. Asia-Pacific Journal of Accounting & Economics, 23(4), pp.449-477.

Payne, D., & C. Raiborn, (2015), Aggressive Tax Avoidance: A Conundrum for Government , and Morality , J Bus Ethics, 147 (3): 469- 487

Phyllis, L. M. (2003). Tax Avoidance and Anti-avoidance Measures in Major Developing Economies. Green Wood publishing Group, U.S.A, P.1.

Ratnawati, V., Freddy, D. and Hardi, H., (2018). Ownership Structure, Tax Avoidance and Firm Performance. Archives of Business Research, 6(1). Pp 1-7

Richardson, G., Wang, B. and Zhang, X., (2016). Ownership structure and corporate tax avoidance: Evidence from publicly listed private firms in China. Journal of Contemporary Accounting & Economics, 12(2), pp.141-158.

Riguen, R., Salhi, B. and Jarboui, A. (2019), "Do women in board represent less corporate tax avoidance? A moderation analysis", International Journal of Sociology and Social Policy, 40(1), pp. 114-132

Salaudeen, Y.M., and B.U.Ejeh, (2018), Equity ownership structure and corporate tax aggressiveness: the Nigerian context, Research Journal of Business and Management (RJBM), 5 (2): 90-99.

Salhi, B., R.Riguen, M.Kachouri, and A.Jarboui, (2019), The mediating role of corporate social responsibility on the relationship between governance and tax avoidance: UK common law versus French civil law, Social Responsibility Journal, 16 (8): 1149-1168.

Salhi,B., Al Jabr,J., Jarboui,A.,(2020). A Comparison of Corporate Governance and Tax Avoidance of UK and Japanese Firms, Comparative Economic Research. Central and Eastern Europe, Volume 23, Number 3,

Sartori, N., (2008), Effects of Strategic Tax Behaviors on Corporate Governance, Available at http://dx.doi.org/10.2139/ssrn.1358930

Setayesh, M. H., Sarvestani, A., & Seydi, S. J. (2014). Exploring the size and independence of the board of directors on a bold tax approach. Applied Research in Financial Reporting, Vol. 3 No. 4, pp. 7-28.

Sugiyanto ,G.P. .; F.K.Genta , A.A. Rahayu, (2020), Corporate Tax avoidance :evidence of implementation of Agency Theory, Talent Develo-pment & Excellence ,Vol.12,No. 1, 2155:2165.

Suleiman, S. (2020), Females in governance and corporate tax avoidance: the moderating effect of accounting conservatism’, Malaysian Management Journal, Vol. 24,

Sunarsih, U., Taviani,K., (2016), Good Corporate Governance in Manufacturing Companies Tax Avoidance, Etikonomi, 15 (2): 85 – 96.

Hussein, A. A., & Zoghlami, F. (2023). The Role of Engineering Insurance in Completing Projects by Using Bank Loans: An Applied Study in a Sample of Iraqi Insurance Companies and Banks. International Journal of Professional Business Review, 8(1), e0926. https://doi.org/10.26668/businessreview/2023.v8i1.926.

THAMS, Y., BENDELL, B. L. & TERJESEN, S. (2018). Explaining women's presence on corporate boards: The institutionalization of progressive gender-related policies. Journal of Business Research, 86, 130-140.

Waluyo, W., (2017), The Effect of Good Corporate Governance on Tax Avoidance: Empirical Study of the Indonesian Banking Company, The Accounting Journal of Binaniaga, 2 (2): 1-10.

Yahaya, K.A., and K.Yusuf, (2020), Impact of Company Characteristics on Aggressive Tax Avoidance in Nigerian Listed Insurance Companies, Jurnal Administrasi Bisnis, 9 (2): 101-111.

Zemzem, A. and Ftouhi, K., (2013). The effects of board of directors’ characteristics on tax aggressiveness. Research Journal of Finance and Accounting, 4(4), pp.140-147