Full Length Research Article - (2023) Volume 18, Issue 5

The Impact Of Net Present Value And Adjusted Present Value On Investment Decisions A Guide From Foreign Companies Invest

Alaa Mohsen Shham* and Dr. Abdelfettah Bouri*Correspondence: Alaa Mohsen Shham, Faculty of Economic Sciences and Management, University of Sfax, Tunisia, Email:

Received: 06-Oct-2023 Published: 20-Oct-2023

Abstract

This study aims to explore the feasibility of adopting international capital budgeting (ICB) Criteria, specifically Net Present Value (NPV) and Adjusted Present Value (APV), as more suitable criteria for international companies when making investment decisions (ID). The study also elucidates the equations related to measuring the results of ICB Criteria, contributing to the estimation and prediction of future cash flows. The research sample included analysts, investors, academics, financial managers, and individuals interested in foreign investments and financial data analysis across all service contract fields. The researcher distributed 343 valid survey forms, including paragraphs and questions, and collected and classified the data using the Statistical Package for the Social Sciences (SPSS version 24). The study concludes that ICB Criteria (NPV and APV) based on discounted cash flows (DCF) are preferred measures for making optimal ID in the Iraqi environment.

Keywords

International capital budgeting. Present value. Adjusted present value. Investment decisions

Introduction

From the prevailing perspective among scholars and practitioners, the success and sustainability of a company ultimately depend on making current ID correctly. In their famous handbook on corporate finance, Brealey, Myers, and Allen mentioned that good investment remains good even if it is not optimally financed. However, poor investment will be a wrong decision even with the best financing policy (Gamsakhurdia, 2015). Considering the investment decision in a specific country involves various considerations, including economic, political, cultural, and strategic changes, in the process of preparing ICB. For example, how the political, economic, legal, and cultural environment of a country can affect the benefits, costs, and risks of conducting business there, thus influencing its attractiveness as an investment location (Jawad et al., 2023; Nehme et al., 2023). This involves discussing the economic theory of foreign investment and identifying a number of criteria that determine the economic attractiveness of a foreign investment opportunity(Alwan et al., 2023; Alyaseri et al., 2023; Salman et al., 2023). The role of political economy is considered, which can be played by government intervention in foreign investment, in an attempt to determine the various benefits, costs, and risks that may flow from investing in a particular location. This is done using the ICB. This complexity faces international companies when investing in another country with different policies and variations in other fields. This enables international companies to objectively and reasonably make decisions among different investment alternatives within countries, and through these criteria, they can make informed choices about where to invest their scarce financial resources. This study contributes, like other ongoing studies, to examining and analyzing the possibility of relying on ICB Criteria for companies and their impact on ID, contributing to achieving competitive advantage, sustainability, and maximizing shareholder wealth by achieving company goals. To highlight the reflections related to ID and the importance of relying on the NPV and APV Criteria as tools to improve the effectiveness and efficiency of ID. Despite the significant support and high suitability achieved by ICB Criteria, their preparation and implementation face many scientific, practical, and problems, whether in how to achieve cash flow estimates and discount rates or in terms of political, social, and environmental impacts and their reflection on ID. Hence, the main research problem emerges: What is the impact of the NPV and APV Criteria on ID? Based on the above, the main research objective is to explain the role of the NPV and APV Criteria in making the best ID for international projects.

Review of literature

International capital budgeting

Several authors have conducted research in advanced countries, offering an international perspective on capital budgeting practices. Researchers have pointed out that ICB decisions face a diverse set of challenges rarely encountered by local companies in capital budgeting preparation. This is because international companies must deal with issues related to exchange rate risks, resource risks, frozen funds, foreign tax regulations, political risks, and differences in the fundamental business risks between foreign and domestic projects (Khan & Jain, 2011: 1299). Despite the complex challenges of international investments, there is a growing trend in establishing subsidiaries by multinational corporations, as well as foreign direct investment by international companies in other countries (Khan & Jain, 2011: 1300). There is a need to distinguish between the basic cash flow and the cash flow for projects, allowing multinational companies the opportunity to assess the cash flow associated with projects in two ways: one may look at the net impact of the project on their steady cash flow, while the other may treat the cash flow independently or uniformly. The theoretical perspective emphasizes that the project should be evaluated from the perspective of the parent company, where dividend distributions and debt repayments are managed by the parent company. This supports the idea that the evaluation is indeed related to the contributions that the project can make to the final result of the international company (Wankel, 2009). According to Doupnik et al. (2020), international companies often need to allocate significant amounts of resources to external projects, anticipating costs and benefits over a long period. These projects, known as capital investments, include examples such as purchasing new equipment and expanding into foreign regions through new investments or acquiring existing operations. Capital investments, when properly managed, often result from precise capital budgeting. ICB focuses on the expected additional cash flows associated with the project (Abdullah & Bin Mansor, 2018; Hadi et al., 2023; Rashem & Abdullah, 2018). Determining these cash flows for international projects creates typical challenges found in local capital projects. However, analyzing international projects is more complicated, even though the basic model follows the same framework proposed by the financial theory of companies. Nevertheless, international companies must consider factors unique to international operations (Buckley, 2012: 397). External projects share the usual difficulties related to local capital projects, with additional complexities in analyzing international investment projects. The same basic model proposed by the financial theory of companies is used in ICB. However, international companies must consider factors unique to international operations (Buckley, 2004: 432). From an interpretive perspective, capital budgeting may be considered more of a construct of reality than a rational choice, involving "manufacturing" or "manufacturing rationality." This construction of rational choice is linked to cultural definitions about the correct approach to dealing with social dilemmas. It is also influenced by ideological settings throughout the entire capital budgeting process, serving international companies as a tool to transfer financial biases and thus focusing on a unique financial aspect in making ID (Schonbohm & Zahn, 2016: 169). In conclusion, ICB is a concept related to managing capital and investing in assets and international projects in a way that aims to achieve maximum value for the company in the long term. International companies with global operations or international investment activities commonly use ICB.

Criteria for international capital budgeting

Net present value criterion

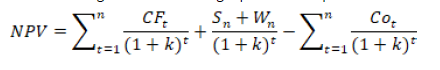

The Criteria for ICB have traditionally been based on DCF (Discounted Cash Flow) tools for making ID. The most commonly used DCF-based criterion is the (NPV) (Munyao, 2009: 11), which is renowned and widely used for investment analysis (Souza & Lunkes, 2016). NPV is recommended frequently as one of the fundamental criteria for financial measurement of investment projects (Szucsne Markovics, 2016). NPV is defined as the present value of cash flows at the required rate of return for the project compared to the initial investment (Hanafizadeh & Latif, 2011). It is also defined as the sum of the present values of the net annual income earned during the project's operational period (Hanafizadeh & Latif, 2011). In practical terms, NPV is a method to calculate the return on investment or expenses for an investment project by considering all the money expected to be earned from the investment and translating it into today's currency value (Gallo, 2014). NPV is also defined as the sum of the present values of incoming (benefits) and outgoing (costs) cash flows over a period of time (Gaspars-Wieloch, 2019). It is described as "the sum of discounted cash flows (inflows) minus the sum of discounted costs (outflows)" (Baker & English, 2011: 60). NPV can be described as the difference between discounted cash inflows and outflows. According to the profitability evaluation method based on NPV, today's cash flow is more valuable than the equivalent future cash flow because the current flow can be invested immediately, starting to generate returns, while this is not possible for future cash flows (Gaspars- Wieloch, 2019). Zizlavsky (2014) suggests that NPV is the most common and advanced criterion. It involves discounting all future cash flows (both internal and external flows) resulting from the project at a specified discount rate (Zizlavsky, 2014). NPV measures the increase in net wealth at present, which is equivalent to the project's implementation (Pasqual et al., 2013: 206). Brunzell et al. (2013: 2) argue that the initial use of the NPV criterion and the evolution of the capital budgeting for the company are linked to company characteristics (size) and variables that serve as an alternative to real option features in company investment projects. Gaspars-Wieloch (2019) asserts that NPV is a good criterion to determine whether a project will produce a positive NPV, indicating that the investment will add value to the company, and therefore, the project can be accepted. On the contrary, if NPV is negative, indicating that the investment will reduce the company's value, the project should be rejected. Academics have long encouraged the use of the NPV criterion due to limitations in the Internal Rate of Return (IRR) criterion (Correia & Cramer, 2008: 33). In calculating the NPV for a project, cash flows occurring at different points in time are adjusted for the time value of money using the discount rate, which represents the minimum required rate of return for the project to be acceptable. Projects with positive present values (or values equal to zero at least) are acceptable, while projects with negative present values are not. If the project is rejected, it is rejected because the cash flows will also be negative (Awomewe & Ogundele, 2008). In financial theory, if there is a choice between two conflicting alternatives, the option producing the higher NPV should be selected. NPV plays a central role in DCF, a Criterion method for using the time value of money to evaluate long-term investment projects. It is widely applied in all fields of economics, finance, and accounting. NPV takes the sequence of cash flows and the discount rate as inputs, outputting a rate (Gaspars- Wieloch, 2019). The NPV criterion is used in ICB to analyze the profitability of an investment project, and it is sensitive to the reliability of future cash flows that the investment or project will generate. For example, NPV compares the value of today's dollar/dinar to the value of the same dollar/dinar in the future, considering inflation and returns (Awomewe & Ogundele, 2008). NPV can be calculated using one of the following separate time equations:

CFt: cash flows after taxes from the first year to the end of the project

Sn: The remaining value (net removal cost) in the final year of the project.

Wn: recovery of working capital in the final year of the project.

COt: External cash flows required for investment.

K: Discount rate (the researcher considers the use of CAMP and the adoption of the parameters of the equation in the host country).

Modified net present value criterion

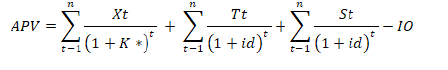

Classical economists suggest using the (APV) criterion (Alieva, 2012), which is an extension of the NPV criterion proposed for use in the analysis of domestic capital expenditures. The APV criterion facilitates the analysis of cash flows unique to international capital expenditures (Eun et al., 2021: 478). Brealey and Myers discuss the concept of APV, where the effects of leverage are explicitly analyzed in the context of capital projects, which have significant side effects on other financial decisions of the company. The APV criterion can explicitly take into account the value of interest tax shields and the interaction between financing and ID (Correia & Cramer, 2008). It adds value to the capital budgeting process, considering each cash flow as a source of value separately (Eun et al., 2021). The main idea is to separate operational cash flows from the side effects of financing and discount the lower-risk financing side effects through low rates (Alieva, 2012). Note that in the APV criterion, each cash flow is discounted at a rate corresponding to the inherent risk in that cash flow (Eun et al., 2021). For analyzing ID, the APV criterion is used to integrate considerations of tax-related capital structure into the analysis of the inflationary effects on the values of investment projects (Ezzell, 2014: 50). The total value of the investment is determined by calculating its unleveraged value first, then adding the value of interest tax shields and subtracting any costs arising from other market imperfections (Berk & DeMarzo, 2020). The criterion is measured according to the following equation (Alieva, 2012):

Xt: Net cash flow after tax for the period

Tt: tax savings in period t due to debt financing.

St: The value of the local currency to support the pre-tax interest rate.

I0: Initial cash investment.

K*: equity ratio

Id: The cost of debt in local currency before taxes.

The APV criterion is characterized by its flexibility, allowing the discount rate to change from year to year. On the downside, this method involves other factors that may be challenging to calculate (Adolfsen, 2021: 22).

Investment decisions

Popescu defines investment decision as the current commitment of funds with an expectation of future cash flows for benefits (Garang, 2016: 3). The decision is described as an enlightened choice based on selecting the appropriate alternative from available options, also known as the process of choosing the best available alternative after conducting a comprehensive study of the expected outcomes of each alternative and its impact on achieving the desired goals (Dosh & Fadhel, 2020). Pandeg assumes that ID or analysis are related to the effective allocation of capital. It involves a commitment of company funds to long-term assets. Such decisions are of great importance to the company because they tend to determine its value by influencing its growth rates, profitability, and risks (Kawugana, 2019; Okanta, 2018). Therefore, decision-making is a rational process or method of choosing one alternative from available alternatives to achieve a specific goal. There are two types of investors in making ID: rational investors and irrational investors. Rational investors make simple decisions based on logical thinking and information about the investment's likelihood. In contrast, irrational investors decide based on their psychological side, leading to biases in ID (Kartini & Nahda, 2021: 1233). We see that the investment decision is the choice of the best positive alternative to achieve the company's strategic goal, relying on the expertise, knowledge, and high skills of the decision-maker, in addition to the availability of information and continuous monitoring for implementation and monitoring of suitable and unsuitable results for the goal. Based on the above, we propose the following hypotheses:

H1: There is a significant impact of the NPV criterion on ID.

H2: There is a significant impact of the Net APV criterion on ID.

Methodology

We distributed 343 valid questionnaire forms for analysis, including a set of paragraphs and questions. The data were collected and classified using the statistical program (SPSS vr. 24). We used two types of statistical analysis: descriptive statistics, including frequencies, proportions, means, standard deviations, variation coefficients, and relative significance, in addition to graphical representations that provide a clearer picture of the nature and characteristics of the data. The second type is analytical statistics, including testing correlation relationships and impact relationships between research variables. Additionally, we used Cronbach's alpha coefficient to test the reliability and stability of the questionnaire form.

Results

Significance test of correlations

Here, we will find and test the correlation relationship by determining the strength and significance between the study variables. The results have been obtained and included in the following table using the statistical program SPSS vr. 24 (Table 1):

| Correlations | ID | |

|---|---|---|

| NPV Criterion | Pearson Correlation | .526** |

| Sig. (2-tailed) | .000 | |

| N | 343 | |

| APV Criterion | Pearson Correlation | .445** |

| Sig. (2-tailed) | .000 | |

| N | 343 | |

Hypothesis 1 (Correlation between NPV and ID):

The formulated hypothesis was: There is no statistically significant relationship between NPV and ID.

Alternative Hypothesis: There is a statistically significant relationship between NPV and ID.

From the above table, it is evident that the correlation value between NPV and ID is 0.526. Since the significance value (sig.) is 0 and is less than 5%, this implies a statistically significant positive correlation at a 5% significance level. Thus, we conclude that an increase in NPV results leads to an increase in the appropriateness and reliability of ID.

Hypothesis 2 (Correlation between APV and ID):

The formulated hypothesis was: There is no statistically significant relationship between APV and ID.

Alternative Hypothesis: There is a statistically significant relationship between APV and ID.

From the above table, it is observed that the correlation value between APV and ID is 0.445. The significance value (sig.) is 0, which is less than 5%, indicating a statistically significant positive correlation at a 5% significance level. Consequently, we infer that an increase in APV results leads to an increase in the appropriateness and reliability of ID.

Impact analysis between research variables

Here, we will test the hypotheses related to the impact analysis of independent variables on the dependent variable. Null hypotheses were formulated for this purpose.

Hypothesis 1 (Impact Test of NPV on ID):

Null Hypothesis: There is no statistically significant effect of NPV on ID. Alternative Hypothesis: There is a statistically significant effect of NPV on ID.

The analysis extracted a set of tables representing the results of the impact analysis. The following table illustrates the values of determination coefficients, corrected determination coefficients, and the standard error value (Table 2).

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | .526a | .277 | .275 | .38052 |

The above table shows that the determination coefficient (R-squared) is 0.28, and the corrected determination coefficient is also 0.28. This indicates that the regression model, which includes the effect of NPV on ID, explains 28% of the total variances, leaving the remaining percentage to be influenced by other variables and factors (Table 3).

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 18.898 | 1 | 18.898 | 130.516 | .000b |

| Residual | 49.376 | 341 | .145 | |||

| Total | 68.274 | 342 | ||||

The table above indicates that the regression model used is statistically significant at a 5% significance level, where the F-test value is 130.516, and the significance value (sig) is equal to zero, which is below the 5% significance level. The following table includes the regression parameters (coefficients) for the NPV criterion in ID and their corresponding t-test values and significance (Table 4):

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 2.326 | .154 | 15.141 | .000 | |

| NPV | .435 | .038 | .526 | 11.424 | .000 | |

From the results, it is evident that the first alternative hypothesis is accepted (there is a statistically significant effect of the NPV criterion on ID). This means that the NPV criterion has a positive and statistically significant impact on ID at a 5% significance level. This is indicated by the calculated t-value of 11.424 and the significance value (sig.) being equal to zero, which is below the 5% significance level. The regression coefficient value is 0.53, suggesting that an increase in the NPV criterion by one unit leads to a 0.53 increase in the appropriateness and reliability of investment decision results.

The second hypothesis (testing the effect of the APV criterion on ID):

The null hypothesis to be tested here is as follows:

Null Hypothesis: There is no statistically significant effect of the APV criterion on ID.

Alternative Hypothesis: There is a statistically significant effect of the APV criterion on ID.

A set of tables representing the impact analysis results was extracted. The following table represents the correlation values, determination coefficients, adjusted determination coefficients, and standard error values (Table 5):

Model |

R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | .445a | .198 | .196 | .40068 |

The results indicate that the determination coefficient is 0.20, and the adjusted determination coefficient is also 0.20. This means that the regression model used, which includes the impact of the APV criterion on ID, was able to explain 20% of the total variations, and the remaining 80% is attributed to other variables and factors. Additionally, we found an Analysis of Variance (ANOVA) table, as shown in the following table (Table 6):

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 13.529 | 1 | 13.529 | 84.269 | .000b |

| Residual | 54.745 | 341 | .161 | |||

| Total | 68.274 | 342 | ||||

The table above indicates that the regression model used is statistically significant at a 5% significance level. The F-test value is 84.269, and the significance value (sig) is equal to zero, which is below the 5% significance level. The following table includes the regression parameters (coefficients) for the APV criterion in ID and their corresponding t-test values and significances (Table 7):

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 2.592 | .162 | 15.999 | .000 | |

| APV | .376 | .041 | .445 | 9.180 | .000 | |

From the above table, it is evident that the first alternative hypothesis is accepted (there is a statistically significant effect of the APV criterion on ID). This means that the APV criterion has a positive and statistically significant impact on ID at a 5% statistical significance level. This is indicated by the calculated t-value of 9.180, and the significance value (sig.) being equal to zero, which is below the 5% significance level. The regression coefficient value is 0.46, suggesting that an increase in the APV criterion by one unit leads to a 0.46 increase in the appropriateness and reliability of investment decision results.

Conclusion

The results show that ICB Criteria are more suitable and beneficial in making ID. There is a need for comprehensive disclosure of information related to assumptions and unobservable data to achieve accurate, reliable, and suitable measurements for making ID based on the results of ICB Criteria. Adopting the best ICB Criteria achieves accurate measurement, producing real and investor-friendly results. Criteria based on the Discounted Cash Flow (DCF) method are the closest to expressing the true value of the investment project. Conducting cash flow and risk prediction processes using proper methods and not expressing them assumptively provides positive and suitable results for investors. It also provides truthful and suitable representation of information in the ICB preparation process, positively impacting investment decision results. Discount rates required according to the Capital Asset Pricing Model vary due to differences in risk degree results, inflation rates, and risk-free interest rates from one country to another.

References

Abdullah, Y. A., & Bin Mansor, M. N. (2018). The moderating effect of business environment on the relationship between Entrepreneurial Skills and Small Business performance in Iraq. Journal of Legal, Ethical and Regulatory Issues, 22(Specialiss).

Adolfsen, K. A. (2021). Valuation of Oslo Klatresenter AS: a fundamental analysis of a Norwegian climbing gym company (Master's thesis).

Alieva, D. S. (2012). Aspects of capital budgeting decision-making process of emerging markets transnational corporations.Вестник Российского университета дружбы народов. Серия: Инженерные исследования, (2), 122-126.

Alwan, S. A., Jawad, K. K., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Aned, A. M., Sharaf, H. K., Flayyih, H. H., Salman, M. D., Abdulrasool, T. S., Abdulrasool, T. S., & Abed, R. A. (2023). The psychological effects of perfectionism on sport, economic and engineering students. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 330–333. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Alyaseri, N. H. A., Salman, M. D., Maseer, R. W., Hussein, E. K., Subhi, K. A., Alwan, S. A., zwaid, J. G., Aned, A. M., Jawad, K. K., Flayyih, H. H., Bachache, N. K., & Abed, R. A. (2023). Exploring the modeling of socio-technical systems in the fields of sport, engineering and economics. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 338–341.

Alzoubi, A., & Alazawi, Y. (2010). Capital budgeting techniques and firms´ performance. Case study: Jordanian listed services firms.

Awomewe, A. F., & Ogundele, O. O. (2008). The importance of the Payback method in Capital budgeting decision.

Baker, H. K., & English, P. (Eds.). (2011). Capital budgeting valuation: financial analysis for today's investment projects (Vol. 13). John Wiley & Sons.

Berk, J. B., & DeMarzo, P. M. (2020). Corporate finance.Global Edition 5th. Pearson Education.

Brunzell, T., Liljeblom, E., & Vaihekoski, M. (2013). Determinants of capital budgeting methods and hurdle rates in Nordic firms. Accounting & Finance, 53(1), 85-110.

Buckley, A. (2012). International finance: a practical perspective. Pearson.

Correia, C., & Cramer, P. (2008). An analysis of cost of capital, capital structure and capital budgeting practices: a survey of South African listed companies. Meditari accountancy research.

Dosh, R. M. A., & Al-Fadhel, M. A. H. (2020). Investment Decisions and Their Relationship to the Opportunity Cost and SWOT Analysis.

Doupnik, T. S., & Perera, M. H. B. (2020). International accounting. Fifth Edition. McGraw-Hill.

Eun, S.Ch., Resnick, G. B.,Chuluun, T. (2021). International Financial ManagemenT 9e. McGraw-Hill Education.

Ezzell, J. R., & Kelly Jr, W. A. (1984). An APV analysis of capital budgeting under inflation. Financial Management, 49-54.

Gallo, A. (2014). A refresher on net present value. Harvard Business Review, 19.

Gamsakhurdia, T., & Maisuradze, K. (2015). The theoretical and practical aspect of selecting the capital budgeting methods. In 3rd Eurasian Multidisciplinary Forum, Emf 2015 19-21 October, Tbilisi, Georgia (p. 47).

Garang, M. (2016). The effect of financial literacy on investment decisions in the Juba City South Sudan (Doctoral dissertation, University of Nairobi).

Gaspars-Wieloch, H. (2019). Project net present value estimation under uncertainty. Central European Journal of Operations Research, 27(1), 179-197.

Hadi, A. H., Abdulhameed, G. R., Malik, Y. S., & Flayyih, H. H. (2023). The influence of information technology (it) on firm profitability and stock returns. Eastern-European Journal of Enterprise Technologies, 4(13(124)), 87–93. https://doi.org/10.15587/1729-4061.2023.286212

Hanafizadeh, P., & Latif, V. (2011). Robust net present value. Mathematical and Computer Modelling, 54(1-2), 233-242.

Jawad, K. K., Alwan, S. A., Alyaseri, N. H. A., Hussein, E. K., Subhi, K. A., Sharaf, H. K., Hussein, A. F., Salman, M. D., zwaid, J. G., Abed, R. A., Abed, R. A., & Aned, A. M. (2023). Contingency in engineering problem solving understanding its role and implications: focusing on the sports machine. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 334–337.

Juhász, L. (2011). Net present value versus internal rate of return. Economics & Sociology, 4(1), 46-53.

Kartini, K., & Nahda, K. (2021). Behavioral Biases on Investment Decision: A Case Study in Indonesia. The Journal of Asian Finance, Economics and Business, 8(3), 1231-1240.

Kawugana, A., & Faruna, F. S. (2019). Role of Financial Statement in Investment Decision Making.

Khan, M. Y., & Jain, P. K.(2011). Financial Management Text, Problems, and Cases. SIXTH EDITION. Tata McGraw Hill Education Private Limited.

Munyao, G. M. (2009). The relationship between capital budgeting methods and performance of water services boards in Kenya (Doctoral dissertation, University of Nairobi).

Nehme, A. A., Hasan, A. M., Al-Janabi, A. S. H., Al-Shiblawi, G. A. K., Salman, M. D., Hadi, H. A., Hasan, M. F., Al-Taie, A. H. H., Al-taie, B. F. K., Ali, S. I., Zghair, N. G., Maseer, R. W., Flayyih, H. H., Hussein, M. K., Al-Saedi, A. H., Al-Ibraheemi, S. A. R. A. A., & Jawad, K. K. (2023). The impact of covid-19 on football club stock integration and portfolio diversification. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 15(5), 562–567.

Okanta, S. U. (2018). Published Financial Statements, Equity-holders’ Investment Decisions and Bank Performance: A Study of Zenith Bank Nigeria Plc. Balance Sheet, 9(8).

Pasqual, J., Padilla, E., & Jadotte, E. (2013). Equivalence of different profitability criteria with the net present value. International Journal of Production Economics, 142(1), 205-210.

Rashem, M. H., & Abdullah, Y. A. (2018). Factors influence the growth and penetration of microfinance institutions: A case of Egypt. Academy of Accounting and Financial Studies Journal, 22(Specialiss).

Salman, M. D., Alwan, S. A., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Sharaf, H. K., Bachache, N. K., Jawad, K. K., Flayyih, H. H., Abed, R. A., zwaid, J. G., & Abdulrasool, T. S. (2023). The impact of engineering anxiety on students: a comprehensive study in the fields of sport, economics, and teaching methods. Revista Iberoamericana de Psicologia Del Ejercicio y El Deporte, 18(3), 326–329. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Schönbohm, A., & Zahn, A. (2016). Reflective and cognitive perspectives on international capital budgeting. critical perspectives on international business, 12(2), 167-188.

Souza, P. D., & Lunkes, R. J. (2016). Capital budgeting practices by large Brazilian companies. Contaduría y administración, 61(3), 514-534.

Subedi, B. S. (2011). Capital Budgeting Practices in Industrial Sector of Public Enterprises of Nepal (Doctoral dissertation, Faculty of Management).

Szucsne Markovics, K. (2016). Capital budgeting methods used in some European countries and in the United States. Universal Journal of Management, 4(6), 348-360.

Valencia Cuevas, L. P., & Yasnó López, C. M. (2018). Valoración financiera de la empresa Empaques del Cauca SA a través de la aplicación de los modelos de valoración Adjusted Present Value y flujo de caja libre con WACC tradicional (Doctoral dissertation, Universidad EAFIT).

Wankel, C. (Ed.). (2009). Encyclopedia of Business in Today's World: A-C (Vol. 1). Sage.

Žižlavský, O. (2014). Net present value approach: method for economic assessment of innovation projects.Procedia-Social and Behavioral Sciences,156, 506-512.