Research Article - (2024) Volume 19, Issue 1

Financial Satisfaction Of Individuals And Its Determinants During The Covid19 Pandemic Using Path Analysis

Himmiyatul Amanah Jiwa Juwita**Correspondence: Himmiyatul Amanah Jiwa Juwita, Doctor, Faculty of Economics and Business, Brawijaya University, MT. Haryono Street, 65141, Malang, Indonesia, Email:

Received: 14-Jan-2024 Published: 20-Feb-2024

Abstract

The COVID-19 pandemic has had a changing impact on the world economy, including Indonesia. This study aims to analyze the influence that income, perceived financial knowledge, perceived financial stress, and COVID-19 awareness had on spending behavior and their impact on achieving financial satisfaction when the COVID-19 variant of the Omicron pandemic hit Indonesia. In this study, path analysis and data collection techniques were used to conduct an online survey of 237 unmarried students with household and occupation registration. The findings from this study are that income, perceived financial knowledge, perceived financial stress, and awareness of COVID-19 have direct and indirect effects on financial satisfaction of individuals. The findings of this study show that, even during the COVID-19 pandemic

Keywords

Covid-19, Financial knowledge, Financial satisfaction, Financial stress, Income, Spending behavior

Introduction

Basically, everyone wants to achieve happiness in their life. The presence of the Covid-19 virus, which has occurred since it was designated by WHO in 2020 as a pandemic status, had increased the happiness level of the Indonesian people in the early days of the pandemic (World Happiness Index, 2021). However, in 2021 there will be a decline in the level of happiness for the Indonesian people because that year Indonesia recorded the highest number of deaths due to Covid-19 and was ranked number 2 in Asia (Worlddometers, 2021; World Happiness Index, 2021). The decline in the happiness of the Indonesian people during the Covid-19 pandemic could be caused by a decrease in their level of life satisfaction because happiness is closely related to life satisfaction (Oquaye et al., 2022). An important focus in achieving life satisfaction levels is often associated with financial problems (Van Praag et al., 2010; Zemtsov & Osipova, 2016; Bruggen et al., 2017; Oquaye et al., 2022). Research related to financial satisfaction can describe the output of the usefulness of a government program performance that is felt directly by individuals in the community so that it is often used as a benchmark for evaluating the performance of development programs by the government (Ristanto, 2022).

The Happiness Level Measurement Survey conducted by the Central Statistics Agency (BPS, 2021) shows that residents with higher incomes also tend to have higher levels of happiness. From this description it can be reflected that the decrease in the level of happiness of the Indonesian people can be caused by a decrease in the income level of the Indonesian people during the Covid-19 pandemic. This is reinforced by data on the decline in Indonesia's economic status from middle-upper to lower-middle class (World Bank, 2020, 2021). In addition, the level of household expenditure per capita, which describes a household's ability to meet their daily needs, has also decreased (BPS, 2021; Izzati, 2021). Approximately 82% of the proportion of productive people in Indonesia (ie, those consisting of generations X, Y, and Z), has experienced a decrease in income due to the Covid-19 pandemic (BPS, 2020). OJK (2020) states that the millennial generation aged 25-44 years is the generation most affected by the Covid-19 pandemic from a financial perspective.

In addition to the declining income of the Indonesian people, the level of financial literacy has also decreased in line with the slowdown in global economic growth due to the uncertainty over how quickly the Covid-19 pandemic will end (Basmar & Hasdiana, 2021; Marzuki et al., 2021). Financial literacy is also known as financial knowledge which leads to information in decision making (Ouachani et al., 2021). OJK (2019) reports data that the level of financial literacy of the Indonesian people is 38%. This figure is much lower than other ASEAN countries (such as Singapore, Malaysia and Thailand), and low when compared to Indonesia's financial inclusion rate which is already at 76%.

In terms of savings ownership, the Household Survey conducted by Susenas (2020) reported that around 51% of Indonesian households did not have savings in the form of money or goods to meet their living needs during the pandemic, and they even tended to choose ways by selling and duplicating goods for the sake of their savings. survive in the face of the Covid-19 pandemic crisis. This condition, in addition to reflecting a low level of financial knowledge, also reflects their inability to maintain the funds they have through the absence of emergency fund ownership.

In terms of investment activities, the Financial Services Authority (2020) stated that the Covid-19 pandemic had caused a decline in the Jakarta Composite Index (IHSG). This condition illustrates that investors are starting to divert their investment in capital market instruments due to concerns about investing in the capital market during the Covid-19 pandemic. Talwar et al. (2020) explained that investor activity in the capital market was heavily influenced by financial issues that were occurring during the pandemic. The same is true of investment in property where the pandemic has caused a decrease in the purchase and demand for property in Indonesia (Dewi et al., 2021).

A person is said to have financial satisfaction if he has: (1) the availability of sources of funds that can be used to fulfill all of his financial obligations, (2) the ability and flexibility in managing money to avoid financial problems, namely lack of money in the future, and (3 ) the ability to maintain and develop financial resources from time to time to achieve long-term financial goals (Bruggen et al., 2017; Zemtsov & Osipova, 2016; Commerton Forde et al., 2018; Botha et al., 2020). Referring to the concept of financial satisfaction and based on the problems described earlier, it indicates a decrease in the level of financial satisfaction during the Covid-19 pandemic.

Individuals in developing countries will experience many challenges in achieving financial satisfaction (Bruggen et al., 2017; Kempson et al., 2017). Financial satisfaction is described as a subjective measure, meaning that even if two individuals have the same income, they will not necessarily have the same financial satisfaction (Kempson et al., 2017; Ali et al., 2015; Xiao & O'Neill, 2018; Housel, 2020; Oquaye et al., 2022). Differences in financial satisfaction felt by individuals are influenced by the development of the stages of the life cycle that they are going through, so that it will lead to different perceptions and interpretations (Hira and Mugenda, 1999; Vera-Toscano et al., 2006; Malone et al., 2010 ).

Although reports from OJK (2019) and previous research explain that income is closely related to financial satisfaction (Delafrooz and Paim, 2011; Kalra Sahi, 2013; Rahman et al., 2021; Owusu, 2021), there are results of previous studies that found a relationship no significant effect between the two (Sadiq et al., 2018). The results of this study can explain that the possibility of income is not the only factor that influences individual financial satisfaction. Along with the increasing number of studies related to financial satisfaction in individuals, everyone is increasingly aware that the money or income they have is not the only way to increase their financial satisfaction (Housel, 2020).

Individuals can achieve high financial satisfaction at any level of income they earn, if they are equipped with knowledge in managing money well (Lusardi & Mitchell, 2014; Housel, 2020). Financial knowledge can predict individual financial satisfaction (Saurabh & Nandan, 2018;Ali et al., 2019;Lee & Dustin, 2021). Individuals who have a high perception of the level of financial knowledge they have will lead to more responsible financial decisions compared to ordinary people in general, because they tend to understand more about various aspects of their financial condition (Saurabh & Nandan, 2018; Lusardi, 2019; Lee & Dustin, 2021). Contrary to the results of this study,financial satisfaction is not influenced by one's financial knowledge (Hirnoven, 2018; Stromback et al., 2020; Owusu, 2021).

On the other hand, the Covid-19 pandemic will certainly not only have an effect on an increasingly uncertain economy but will also have an impact on everyone's psychological condition (Panayiotou et al., 2021). Economic uncertainty has an impact on psychological disorders of individual emotions in the form of feelings such as: anxiety, fear, and depression (Zajacova et al., 2020; Florin et al., 2020). Disorders of anxiety, fear, and depression can arise because individuals have the perception of not being able to meet all their needs due to limited funds they have or what is referred to as financial stress (Rahman et al., 2021; Xiao & Kim, 2021).

Individuals can unconsciously be careless in managing their finances and can ultimately hinder the achievement of financial satisfaction, if they are unable to control their emotional psychological conditions that come from within the individual and their environment (Joo & Grable, 2004; Sabri & Falahati, 2013; Lee & Dustin, 2021; Rahman et al., 2021). Behavioral financial theory explains that in behaving, individuals are often influenced by psychological factors in decision making so that they often behave irrationally (Ricciardi & Simon, 2000). The concept and results of this study are different from previous research (Sherlyani & Pamungkas, 2020).

In addition to these three factors, it is known that the experience factor of the Covid-19 pandemic can also influence individual financial satisfaction (Yuesti et al., 2020; Memarista et al., 2022), along with the abundance of information and ease of access in finding information about Covid-19. 19 will raise awareness among the public regarding the Covid-19 virus (Pham et al., 2020; Anand et al., 2020). Awareness is an individual's sensitivity to things that are happening which in this study are related to the Covid-19 virus (Goleman, 1998; Onder, 2006). The presence of awareness of Covid-19 can lead to vigilance and preparation so that it encourages the formation of good money management behavior so that it can have an impact on financial satisfaction (Rogers, 1974; Capuano and Ramsay, 2011; Widyastuti et al., 2016; Singh & Verma, 2023). Covid-19 awareness has an indirect influence on financial satisfaction (Anand et al., 2020). To the best of the researchers' knowledge, studies regarding the influence relationship that occurred between Covid-19 awareness on financial satisfaction were found to be very limited.

The inconsistency of research results between income, financial knowledge, financial stress, and financial satisfaction, illustrates the possibility of the need for a mediating variable that can bridge the influence relationship that occurs between the two. The results of previous research explain that financial behavior can be used as a mediating variable and is the strongest influence in achieving financial satisfaction (Saurabh & Nandan, 2018; Aliet al., 2019; Rahman et al., 2021).

Theory of Life-Span Development (Baltes, 1987 in Santrock, 2012) supports financial behavior which can be used as a mediating variable in influencing financial satisfaction, along with the life cycle development phase, every human being must understand what factors are able to make them achieve satisfaction in life which in this study is financial satisfaction. The achievement of financial satisfaction in every human being is inseparable from the adoption of the behavior that is formed, so that every human being must try to form a good behavior in order to be able to achieve satisfaction and success in life (Ajzen, 2005). Factors forming behavior in the development of human life are often colored by psychological emotional processes, the level of knowledge possessed, as well as environmental influences that often change according to the conditions of the development phase of human life (Bruggen et al., 2017; Mahendru, 2021). Factors underlying an individual's behavior often involve emotional processes, characteristics, and preferences that are also explained through financial behavior theory (Ricciardi & Simon, 2000; Baker & Nofsinger, 2010). Furthermore, the Theory of Planned Behavior (Ajzen, 2005) explains that a person behaves because there are several underlying factors, including interactions between personal characteristics, attitudes, norms, and self-control that trigger intentions to behave well or not. Factors underlying an individual's behavior often involve emotional processes, characteristics, and preferences that are also explained through financial behavior theory (Ricciardi & Simon, 2000; Baker & Nofsinger, 2010). Furthermore, the Theory of Planned Behavior (Ajzen, 2005) explains that a person behaves because there are several underlying factors, including interactions between personal characteristics, attitudes, norms, and self-control that trigger intentions to behave well or not. Factors underlying an individual's behavior often involve emotional processes, characteristics, and preferences that are also explained through financial behavior theory (Ricciardi & Simon, 2000; Baker & Nofsinger, 2010). Furthermore, the Theory of Planned Behavior (Ajzen, 2005) explains that a person behaves because there are several underlying factors, including interactions between personal characteristics, attitudes, norms, and selfcontrol that trigger intentions to behave well or not.

The financial impact felt by individuals due to the Covid-19 pandemic, made researchers want to analyze and review how income, financial knowledge, financial stress, and awareness of Covid-19 can influence the formation of spending habits for individuals in achieving financial satisfaction. As far as literacy studies are conducted by researchers, research on the influence of Covid-19 awareness on the formation of financial behavior as reflected in behavior in spending money, and financial satisfaction in unmarried individuals using the path analysis method, has never been done before. Research related to financial satisfaction has been carried out before. Researchers previously conducted research by creating relationships between different variables, objectives, methods, subjects, and variables (Falahati et al., 2012). Therefore, this research is still feasible and relevant to be re-examined at this time, using different measurement approaches and methods.

Literature Reviews

Financial Satisfaction

Financial satisfaction is the level of perceived satisfaction felt by individuals because they have sufficient money to meet all their needs and desires (Hira & Mugenda, 1999; Bruggen et al., 2017). The concept of financial satisfaction can be described as a subjective measure as a means of achieving quality of life satisfaction, which is further described as a form of happiness (Malone et al., 2010; Kempson et al., 2017; Zemtsov & Osipova, 2016; Bruggen et al. al., 2017; Barrafrem et al., 2020; Oquaye et al., 2020; Mahendru, 2021). Various ways can be improved by individuals to be able to achieve financial satisfaction even though they are facing challenges due to the Covid-19 pandemic. Financial satisfaction can be achieved by individuals if they are able to form good money management behavior.Zemtsov & Osipova, 2016; Bruggen et al., 2017; Barrafrem et al., 2020; Mahendru, 2021; Owusu, 2021).

Income

All incoming cash that can be sourced from receiving salaries, wages, bonuses, tips, royalties, commissions, and other business results that are obtained routinely by individuals every month before taxes and other deductions are defined as income (Aboagye and Jung, 2008; Archuletta et al. al., 2013; Lestari, 2020). Income owned by individuals can further increase consumptive patterns to meet their needs and desires so that it will be easier to achieve satisfaction in their lives (Newman et al., 2006). The higher the income earned, the more flexibility individuals will have in managing their finances (Lee & Dustin, 2021; Rahman et al., 2021). Freedom in managing money is synonymous with the characteristics of people who have financial satisfaction (Bruggen et al., 2017; Commerton Forde et al., 2018; Botha et al., 2020). The theory of needs (Maslow, 1943, 1958) supports this, that money is needed by every individual, especially to fulfill his most basic needs first (such as clothing, food, shelter, education, health) in order to be able to achieve satisfaction to achieve a higher level of needs. The next high because basically human nature always wants to achieve satisfaction at a higher level of needs.

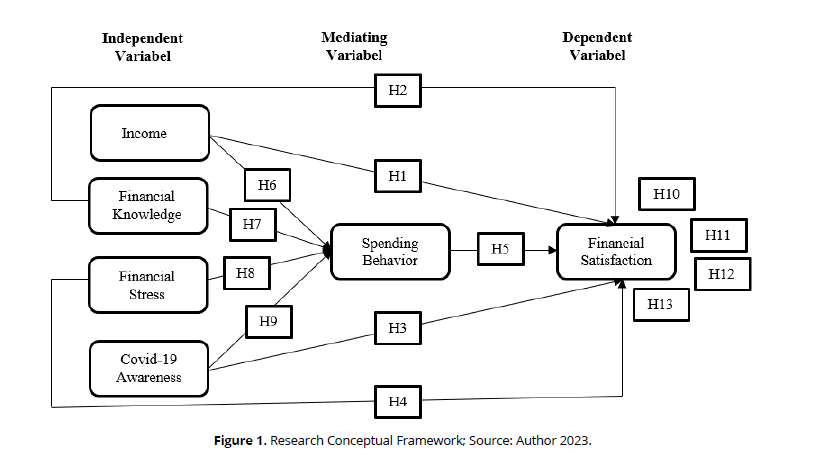

H1: Increasing individual income, will be able to further increase financial satisfaction

Financial Knowledge

Financial knowledge is an individual's understanding of the concept of financial management so that they can make the right financial decisions and avoid financial problems (Noctor et al., 1992; Chen & Volpe, 1998; LaBorde et al., 2013; Lusardi & Mitchell, 2014; Ouachani et al. al., 2021). The main problem in individual finances is lack of money. A person is said to have good financial knowledge if he can make rational financial decisions (Lusardi & Mitchell, 2014). Financial knowledge is often associated with a person's level of confidence in understanding how well he understands the concept of managing his personal finances (Saurabh & Nandan, 2018; Riitsalu & Murakas, 2018; Lind et al., 2020). Financial knowledge that uses the perception of self-assessment, will better describe past experience, self-control, and confidence in making the right financial decisions (Clark et al., 2017; Saurabh & Nandan; 2018). Individuals who have high confidence and self-confidence that they have good financial knowledge will tend to be more responsible in every financial decision making. Previous research supports this (Robb & Woodyard, 2011; Riitsalu & Murakas, 2018; Saurabh & Nandan, 2018; Lind et al., 2020; Lee & Dustin, 2021), financial knowledge that is subjectively measured is found to have a strong influence in shaping financial behavior so that it has an impact on increasing financial satisfaction, compared to financial knowledge which is measured objectively using individual cognitive abilities. 2014; Saurabh and Nandan, 2018; Lee and Dustin, 2021, Owusu, 2021). 2014; Saurabh and Nandan, 2018; Lee and Dustin, 2021, Owusu, 2021).

H2: Increasing individual financial knowledge will be able to further increase financial satisfaction.

Financial Stress

Perceptions of individual emotional psychological states in the form of worry, anxiety, excessive fear related to the availability of money and debt ownership are defined as financial stress (Lee & Dustin, 2021; Xiao & Kim,2021; Rahman et al., 2021). Different terms are also used to describe the same construction as financial stress, including: financial strain, financial anxiety, financial uncertainty, and economic worry (Xiao & Kim, 2021). Psychological factors (such as financial stress) have a role in determining financial satisfaction, especially in conditions of ongoing economic crises such as the Covid-19 pandemic (Gardarsdottir & Dittmarr, 2012; Barrafrem et al., 2020; Mahendru, 2021). The Covid-19 pandemic has created uncertainty for the world economy and everyone can have different perceptions and strategies in dealing with these conditions, such as: some are increasingly focused on managing money properly, and on the contrary, some are ignoring matters related to with personal financial management information (Barrafrem et al., 2020). Failure to manage money will cause financial stress and will have a negative impact on productivity in all aspects of life so that it will reduce the level of financial satisfaction (Gardarsdottir & Dittmar, 2012; Delafrooz and Paim, 2011; Mahendru, 2021). Research by Memarista et al. (2022) explained that Indonesian people experienced an increase in financial anxiety during the Covid-19 pandemic. Individuals who have financial stress tend to act irrationally by taking short-cut solutions such as going into debt or borrowing money, so that all their needs are met (Mahendru, 2021; Rahman et al., 2021; Lee and Dustin, 2021). Debt is bad financial behavior because it can further worsen a person's financial condition if it is not measurable, on the other hand debt can also further build wealth (Walson & Flitzsimmons, 1993; Mahendru, 2021). Debt behavior can result in a person's tendency to reduce saving behavior (Aboagye & Jung, 2018). Behavioral financial theory (Ricciardi & Simon, 2000; Mahendru, 2021) supports this, that if individuals are more inclined to emotional psychological influences it can have an impact on making irrational financial decisions, it means having a bad impact on his life, so that it will reduce his financial satisfaction. On the other hand, based on Maslow's theory of needs (1943, 1958) explains that everyone must be able to try to meet their basic needs first. Satisfaction will be achieved after basic needs are met, and someone will try to meet higher needs, which require a sense of financial security. Individuals who have indications of financial stress may occur due to unfulfilled basic needs in the form of the need to meet the basic needs of life every day so as not to cause feelings of satisfaction. 1958) explains that everyone must be able to try to meet their basic needs first. Satisfaction will be achieved after basic needs are met, and someone will try to meet higher needs, which require a sense of financial security. Individuals who have indications of financial stress may occur due to unfulfilled basic needs in the form of the need to meet the basic needs of life every day so as not to cause feelings of satisfaction. 1958) explains that everyone must be able to try to meet their basic needs first. Satisfaction will be achieved after basic needs are met, and someone will try to meet higher needs, which require a sense of financial security. Individuals who have indications of financial stress may occur due to unfulfilled basic needs in the form of the need to meet the basic needs of life every day so as not to cause feelings of satisfaction.

H3: Increasing financial stress on individuals will be able to further increase financial satisfaction.

Omicron COVID-19 Awareness

Awareness is an individual's sensitivity to things that are happening related to Covid-19, especially in the Omicron variant (Goleman, 1998; Onder, 2006). Since Covid-19 was designated as a Global Pandemic by WHO on March 11 2020, many countries have started implementing policies and preventive measures to reduce the spread of the Covid-19 virus. The Indonesian government is also implementing various preventive measures, such as: implementing social distancing, lockdown, isolation, and even imposing a curfew, as stipulated in PP No. 21 of 2020. The activity restrictions implemented in Indonesia have caused a number of economic losses (Hardiwadoyo, 2020). Siallagan's research (2020) explains that the Indonesian people experienced financial difficulties during Covid-19 which was reflected in a decrease in the level of public consumption which was limited in meeting basic needs. Activity restrictions will have an effect on decreasing financial satisfaction if individuals are unable to have awareness of the symptoms, causes of disease, prevention and control of the Covid-19 virus (Anand et al., 2021). Individuals who have a high level of awareness of the Omicron variant of Covid-19, are expected to have earlier attention, vigilance, and preparation to overcome the worse impact that will occur on their financial condition because awareness is an intrinsic factor that causes one's financial satisfaction (Rogers, 1974, Capuano & Ramsay, 2011; Widyastuti, et al., 2016). The presence of awareness of Covid-19 can increase one's level of health where the level of health is an important factor so that a person can work well so that he is able to have income and it will be easier to obtain financial satisfaction (Savage et al., 2020; Memarista et al., 2022; Singh & Verma, 2022). Theory of Life Span Development which explains that factors from social-emotional processes originating from circumstances around a person's environment can trigger high and low life satisfaction, supporting this (Baltes in Santrock, 2012). 2020; Memarista et al., 2022; Singh & Verma, 2022). Theory of Life Span Development which explains that factors from social-emotional processes originating from circumstances around a person's environment can trigger high and low life satisfaction, supporting this (Baltes in Santrock, 2012). 2020; Memarista et al., 2022; Singh & Verma, 2022). Theory of Life Span Development which explains that factors from social-emotional processes originating from circumstances around a person's environment can trigger high and low life satisfaction, supporting this (Baltes in Santrock, 2012).

H4: Increased awareness of COVID-19 Omicron in individuals will be able to further increase financial satisfaction.

Spending Behavior

Spending behavior includes part of financial behavior. Behavioral finance isindividual attitudes and abilities in managing finances to be successful in life (Hira and Mugenda, 1999; Loix et al., 2005; Xiao, 2008; Falahati et al., 2012). Previous research has explained many different concepts about financial behavior. Fachrudin & Silalahi (2022) use measurements of investment and debt behavior as part of financial behavior. Copur & Gutter (2019) uses measurements of spending and saving behavior as a combined part of measuring behavior towards money management. The same was done by previous researchers (Sabri and MacDonald, 2010; Widyastuti, et al, 2016; Setiawan et al., 2020; Rahman et al., 2021). Previous research underlined the importance of measuring money management behavior towards spending behavior (Setiawan et al., 2020). Someone who has good behavior in spending the funds they currently have will have a major influence on their habits in carrying out saving and investing activities in the future (Sabri & MacDonald, 2010; Hayhoe & Gutter, 2012; Jeevitha & Priya, 2019; Setiawan et al., 2020). The behavior of spending funds includes activities of planning spending of funds, activities of being able to set aside part of the funds to be spent entirely, and activities of being able to buy goods according to their needs (Andriani & Nugraha, 2018). The same thing was conveyed by Hayhoe & Gutter (2012) that a person is said to have good financial behavior if he: (1) spends less money than he earns, (2) has a written spending plan, (3) monitors his spending plan, and (4) have clear goals. A person who is skilled at managing his funds as shown through spending his funds rationally will have an influence on increasing his financial satisfaction (Atkinson and Messy, 2012; Owusu, 2021; Rahman et al., 2021; Lee and Dustin, 2021). Behavioral finance theory supports this (Ricciardi & Simon, 2000). This theory emphasizes the importance of a person to override emotional psychological influences in making decisions in order to achieve life satisfaction. In addition, the theory of needs (Maslow, 1943, 1958) also supports this, that if a person has a high level of income and has good financial knowledge, then if a person is unable to control the psychological emotions that arise from the financial stress he has , then it can trigger financial decisions that are not in accordance with their own needs or can be said to be inappropriate. Making the wrong financial decisions will result in an inability to manage finances properly. Individuals who are unable to manage their finances well will find it difficult to fulfill their needs, desires and fulfill all their obligations, so that financial satisfaction will be difficult to achieve. The influence of financial behavior on financial satisfaction is supported by the theory of planned behavior that individual characteristics, attitudes, norms, and self-control work together in the formation of a behavior (Ajzen, 2005).

H5: The better a person is at spending his funds, the more financial satisfaction he will be able to increase.

The theory of life-span development (Baltes, 1987 in Santrock, 2012) explains that humans must know what can shape the achievement of life satisfaction and well-being, along with the time and development of their life cycle. The theory also emphasizes the importance of forming behavioral habits that can create one's life satisfaction. Based on this theory, achieving well-being and financial satisfaction is influenced by various factors. These factors include normative factors, in this case income. Cognitive factors in the perspective of this theory that the development of financial satisfaction can be triggered from the level of financial knowledge. The next factor explaining the triggers for individuals to achieve financial satisfaction is triggered by socio-emotional factors, namely the level of financial stress. Interaction factors between environment, history, and social can explain each individual's awareness of Covid-19 which can trigger the achievement of financial satisfaction. These factors can influence the behavior habits of each individual in this case is the financial behavior of each individual, to achieve financial satisfaction.

More about the formation of one's behavioral habits is explained through Theory of Planned Behavior (TPB) (Ajzen, 2005). According to this theory, individual behavior habits are formed by intentions in taking action, which in forming an intention will be influenced by various kinds of internal and external factors. Every action adopted by an individual is strongly influenced by the belief that the action can be carried out successfully, the existence of elements of social environmental factors that support the adoption of the action, and having a positive attitude towards the action. This theory has been widely confirmed that the level of income, knowledge possessed by a person, emotional psychological elements,

H6: Increasing individual income will be able to further improve one's good habits in carrying out spending activities.

H7: Increasing individual financial knowledge will be able to further improve one's good habits in carrying out spending activities.

H8: Increasing individual financial stress will be able to further reduce one's good habits in carrying out spending activities.

H9: Increased awareness of COVID-19 in individuals will be able to further improve one's good habits in carrying out their fundraising activities.

H10: Increased income mediated by the better a person is in spending his funds, will increase his financial satisfaction.

H11: Increasing individual financial knowledge mediated by getting better at spending their funds will increase their financial satisfaction.

H12: The increase in individual financial stress mediated by the better a person is in spending his funds will increase his financial satisfaction.

H13: Increasing individual awareness of COVID-19, mediated by getting better at spending their funds, will increase their financial satisfaction.

Based on the description of the hypothesis, it can be described the causality relationship between variables as shown in (Figure 1)

Methodology

Respondent

To test the hypothesis, this study used a quantitative research approach, using a questionnaire and cross-sectional data from respondents who were selected based on certain criteria. Data was collected electronically via Google Forms, at the time the Omicron variant of the COVID-19 case first appeared in December 2021.

Respondent criteria used in this study were selected based on selecting population criteria with a saturated sample to be able to meet the elements of internal validity related to the variables to be studied (such as: financial satisfaction which is closely related to individual income gain, and financial knowledge is closely related to financial background). behind individual financial education). The population criteria in this study were: (1) students with enrolled status in the Master of Management Study program, (2) having studied related to financial management courses, (3) having a job, and (4) having unmarried status. The reason for selecting Master of Management Students as the subject of this research is due to the following.

1. Master of management students are considered to have studied courses related to financial management which are closely related to the financial knowledge variable that will be examined in this study. Business majors have a higher perception of financial knowledge than other majors (LaBorde et al., 2013).

2. Master of management students have the same educational background, that is, have taken undergraduate or undergraduate studies. The level of education is very important in influencing individual financial satisfaction (Owusu, 2021).

3. Master of management students have a tendency not only to study, but also to work.

4. Master students are relatively younger than doctoral students, so they have a tendency to have unmarried marital status.

5. Previous research revealed that a homogeneous group is needed to provide a correct assessment of financial satisfaction (Oquaye et al., 2020).

Based on the selection criteria for the respondent population, a total saturated sample of 237 students was obtained. This is in accordance with Hair et al. (2017) that the minimum sample for an exploratory study is at least ten times the number of constructs in the study. This study used 6 construct variables, meaning that the minimum sample used in this study was 60, while in this study a sample of 237 students was used from the total number of Master of Management students at Brawijaya University, which totaled 353 students.

Measurement

Income. Measured on the basis of all cash inflows which can be sourced from receiving salaries, wages, bonuses, tips, royalties, commissions, or other business results that are obtained routinely by individuals every month before taxes and other deductions, using an interval scale of 5 categories based on East Java Provincial Minimum Wage (UMP) data for 2022, namely: (1) ≤Rp. 2,000,0000, (2) Rp. >2,000,000 – Rp. 4,000,000, (3)> Rp. 4,000,000 Rp. 6,000,0000, (4)> Rp. 6,000,000 – Rp. 8,000,000, and (5) > Rp. 8,000,000.

Financial Knowledge. Measured based on definitions from Chen & Volpe (1998), LaBorde et al (2013), Adiputra (2021) measures financial knowledge through an understanding of: basic general personal finance, money management, credit and debt, savings and investment, and risk management. Based on these definitions, researchers created a financial knowledge perception scale using a 5-point perception measurement scaleLikert based on respondents' responses to a scale of 1 (strongly disagree) to 5 (strongly agree). The higher the score on the scale indicates the perceived level of better financial knowledge.

Financial Stress measured based on the definition from Lee & Dustin (2021); Rahman et al. (2021), which measures the level of financial stress on: debt ownership, and perceived fears of not being able to meet needs in the short and long term. Based on this definition, the researcher constructed a scale of perceptions of financial stress on debt ownership using a 5-point Likert scale perception measurement based on respondents' responses to a scale of 1 (if all sources of indications of debt stress were answered no or the total score was 0) to a scale of 5 ((if all sources of debt stress indications answered no or a total score of 4). Meanwhile, to measure financial stress on perceived concerns in having sufficient money in the short and long term, measured using a 5-point Likert scale measurement perception based on respondents' responses to a scale of 1 (strongly disagree) to a scale of 5 (strongly agree). The higher the score indicates a person's tendency to have a higher level of financial stress.

COVID-19 awareness. measured according to the definition of Anand et al. (2020), using a 5-point Likert scale based on respondents' responses to a scale of 1 (disagree) to 5 (strongly agree). The higher the score indicates a person's tendency to have a higher level of awareness.

Spending behavior. measured based on the definition of Adriani & Nugraha (2018), Setiawan et al. (2020), using a 5-point Likert scale based on respondents' responses to a scale of 1 (disagree) to 5 (strongly agree). The higher the score, the more stringent the individual's tendency to spend the funds they have. Conversely, the lowest scores reflect individuals who are looser in managing money. Behavior in spending activities is categorized into two parts: Scores 1-3 reflect loose spending and scores above 3 to 5 indicate better money management behavior.

Financial Satisfaction. Measured based on the definition of Hira & Mugenda (1999),Commerton Forde et al. (2018), Botha et al. (2020), Muresan et al. (2021), using several items that reflect satisfaction with: (1) the availability of sources of funds that are able to be used to fulfill all of its financial obligations (measured by being satisfied with the amount of income currently earned), (2) the ability and flexibility in managing money to avoid financial problems, namely lack of money in the future (satisfied with having knowledge in managing money, satisfied with the ability to pay bills on time), and (3) the ability to maintain and develop sources of funds owned from time to time to achieve longterm financial goals (satisfied with the amount of savings currently owned , satisfied with the ownership of investment assets (both real investment assets (property, gold) and financial (deposits, bonds, mutual funds, crypto)), satisfied with the ownership of protection funds in the form of insurance).

Data Analysis Technique

The collected data is processed and analyzed with SPSS with path analysis. First, a pilot test was conducted to measure the validity and reliability of the research instrument in the form of a questionnaire as a research measurement tool. Then performed analysis techniques, including: descriptive statistics, classic assumption test, path analysis, and Sobel test (Sekaran & Bougie, 2016).

Results

Relationship between Variables

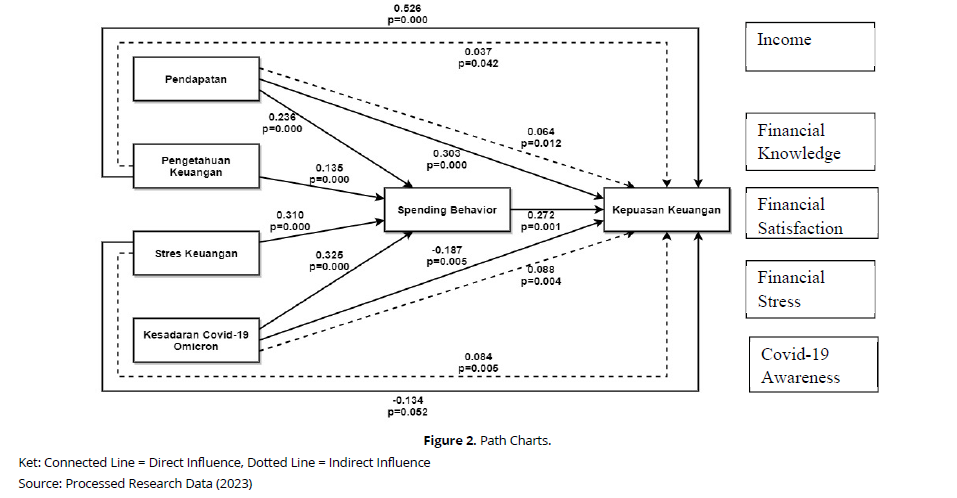

The results of the path analysis are presented in Figure 2. The path analysis test is divided into three parts, namely (1) examining the direct effect of the independent variables on spending behavior, (2) testing the direct effect of the independent variables and spending behavior on financial satisfaction, and (3) examine the indirect effect of income, independent variables on financial satisfaction through spending behavior. In addition, the results of the path analysis test are also presented in (Figure 2, Table 1).

| Variable | Equation 1 | Equation 2 | Sobel test | |||

|---|---|---|---|---|---|---|

| Koef. | p.s | Koef. | p.s | Koef. | p.s | |

| Income | 0.236 | 0.000 | 0.303 | 0.000 | 0.064 | 0.012 |

| Financial Knowledge | 0.135 | 0.006 | 0.526 | 0.000 | 0.037 | 0.042 |

| Financial Stress | 0.310 | 0.000 | -0.134 | 0.052 | 0.084 | 0.005 |

| Covid-19 awareness | 0.325 | 0.000 | -0.187 | 0.005 | 0.088 | 0.004 |

| Spending Behavior | - | - | 0.272 | 0.001 | ||

| Coefficient of Determination (R2) | 75.9% | 60.7% | ||||

Direct Effect (First Equation)

Based on Table 1. Presents the results of the analysis of the direct influence on income, financial knowledge, financial stress, and awareness of Omicron's Covid-19 on spending behavior with the following equation.

Z = 0.236 X1 + 0.135 X2 + 0.310 X3 + 0.325 X4 + e1

Spending behavior: The findings of this study show that the level of spending behavior is related to income, financial knowledge, financial stress, and awareness of COVID-19. A positive income coefficient is interpreted as those who have a higher level of income; the better they are at managing their finances in terms of spending their funds. Financial knowledge has a positive direct effect on spending behavior indicating that those who have a good level of understanding of the concept of money management report having better money management as well. However, those with high levels of financial stress report better management of their money. which is reflected through the activity of increasingly planning personal financial budgeting, avoiding extravagance, and a lifestyle of hedonism. As expected, the higher a person's awareness of COVID-19, especially the Omicron variant, will make them better at spending their funds.

Direct Effect (Second Equation)

Based on Table 1 Presents the results of the analysis of the direct effect on income, financial knowledge, financial stress, and awareness of Covid-19 on financial satisfaction with the following equation.

Y = 0.303 X1 + 0.526 X2 – 0.134 X3 – 0.187 X4 + 0.272 Z + e2

Financial satisfaction: The findings of this study indicate that financial satisfaction is related to income, financial knowledge, financial stress, awareness of COVID-19, and spending behavior. A positive income coefficient is interpreted as those who have higher levels of income will report having higher financial satisfaction. Financial knowledge has a positive direct effect on financial satisfaction indicating that those who have a good level of understanding of the concept of money management report having better financial satisfaction as well. In accordance with the theory of planned behavior (Ajzen, 2005), financial behavior (Ricciardi & Simon, 2000), and needs (Maslow1943,1958)that those who have a high level of financial stress report lower financial satisfaction, which is reflected through satisfaction with the availability of funds, the ability to manage money well, and maintain and develop the wealth they have. Other findings actually reveal that the higher the level of awareness of COVID-19 will actually make them have a lower level of financial satisfaction.

Sobel Test

The Sobel test is to examine the indirect effect of income, financial knowledge, financial stress, and awareness of Covid-19 on financial satisfaction through spending behavior. The results of the Sobel test show that there is an indirect effect of income, financial knowledge, financial stress, awareness of Covid-19, on financial satisfaction through spending behavior. The four independent variables have a positive and significant direction of the coefficient, meaning that good behavior in spending their funds will bridge them to be able to achieve high financial satisfaction, even though they are in conditions of lack of income, lack of good understanding in managing money, reporting self has indications of financial stress.

Implications

Individuals can use these findings to serve as a guide to improve their financial satisfaction. Based on this research data, it shows that the level of education is very important in forming financial knowledge and reducing financial stress. Someone who has a high financial education tends to be more confident in using the knowledge they learn, and they will behave in a more financially responsible manner, which is reflected in the way they spend their money. Someone with a high level of educational background will more quickly realize that he is having indications of financial stress, so he will be more aware of putting aside his psychological emotions in making a financial decision. Therefore, then a more rational financial decision will be created, meaning that it will be able to have a good impact on him in the future. This research also found that during the Covid-19 pandemic, to be precise when the Omicron variant first appeared, individuals were still focused on fulfilling the basic needs of their daily life, so they had not yet reached the next level of need, namely the need for a sense of security, because they were trying to achieve satisfaction. at the level of basic needs. This is in accordance with the theory of needs (Maslow that is, the need for security, because it is trying to achieve satisfaction at the level of basic needs. This is in accordance with the theory of needs (Maslow that is, the need for security, because it is trying to achieve satisfaction at the level of basic needs. This is in accordance with the theory of needs (Maslow1943,1958). This study also found that the indicators on the question item were satisfied with the ownership of an insurance protection fund, other than insurance that was dependent on where he worked, was found to have the lowest response. this condition means, that it is important for them to be more encourage insurance ownership efforts. This study found that the younger generation is not interested in having insurance as a form of protection against risk. Therefore, it is necessary to have support from insurance service managers to be able to provide appropriate information and education about the benefits of insurance, along with the rise of negative news related to insurance.

The results of this study provide information related to things that need to be improved and improved on individuals. It is hoped that the role of educators from institutions or institutions providing financial knowledge education, as well as other financial practitioners, is expected to be able to help their clients increase financial satisfaction by changing their financial behavior towards a more rational, productive, precise, and prioritized scale going forward. In addition, it is important for them to provide understanding and information in financial skills such as: regarding an understanding of general basic personal knowledge, namely interest rates, inflation, personal net worth, and financial planning steps, as well as an understanding of managing income and expenses , understanding of credit and debt, understanding of savings and investment, as well as risk management. Data from the questionnaire shows that although the respondents have a high educational background, there are some of them who lack basic concepts and calculations in the personal finance system.

Conclusion

This study uses path analysis to reveal a framework for exploring the determinants of financial satisfaction, especially during the Covid-19 pandemic era. Based on a combination of research findings, empirically observed theoretical relationships, and from previous studies on financial satisfaction, this conceptual framework provides further insight into the factors that determine financial satisfaction. However, these findings are limited by the nature of the sample and the exploratory nature of the analysis.

The conceptual framework presented here identifies direct and indirect effects on personal financial satisfaction. Income, financial knowledge, financial stress, as well as Covid-19 awareness were found to be determinants that have a direct or indirect effect on financial satisfaction.

The findings from this study specifically reveal the importance of individuals having a high educational background, so that they are able to form a responsibility in forming good money-spending behavior habits, meaning that they are able to control their level of financial spending by making more rational decisions. Higher education background was also found to be very important in reducing financial stress that a person has, so that even though they are in a state of financial stress, they will still be able to think rationally in making financial decisions by finding a way out in the form of a solution that can have a good impact on their life. On the other hand, even in the conditions of the Covid-19 pandemic era, it did not affect the average respondent in having a high level of financial satisfaction.

Acknowledgements

Author Contributions

Funding: This research was funded by the author

Institutional Review Board Statement: Ethical review and approval were waived for this study, due to the fact that the research does not deal with vulnerable groups or sensitive issues.

Data Availability Statement: The data presented in this study are available on request from the corresponding author. The data are not publicly available due to privacy.

Conflicts of Interests: The authors declare no conflict of interest

References

Aboagye, J., & Jung, JY (2018). Debt holding, financial behavior, and financial satisfaction. Journal of Financial Counseling and Planning, 29(2), 208-218. https://doi.org/10.1891/1052-3073.29.2.208.

Adiputra, IG (2021). The influence of financial literacy, financial attitude and locus of control on financial satisfaction: Evidence from the community in Jakarta. KnE Social Sciences, 5(5), 636–654.https://doi.org/10.18502/kss.v5i5.8848

Ajzen, I. (2005). EBOOK: Attitudes, Personality and Behavior. UK: McGraw-Hill Education. Available at:https://books.google.co.id/(Accessed May 20, 2020).

Ali, A., Rahman, MSA, & Bakar, A. (2015). Financial satisfaction and the influence of financial literacy in Malaysia. Social Indicators Research, 120, 137-156.https://doi/org/10.1007/s11205-014-0583-0

Ali, W., Javaid, R., & Ali, S. (2019). Influence Of Life Events On The Financial Satisfaction Of Individuals. IBT Journal of Business Studies (JBS), 1(1).http://dx.doi.org/10.46745/ilma.jbs.2019.15.01.10

Anand, S., Mishra, K., Verma, V., & Taruna, T. (2020). Financial literacy as a mediator of personal financial health during COVID-19: A structural equation modeling approach. Emerald Open Research, 2. https://doi.org/10.35241/emeraldopenres.13735.2

Andriani, D., & Nugraha, N. (2018, August). Spending habits and financial literacy based on gender on employees. In IOP Conference Series: Materials Science and Engineering (Vol. 407, No. 1, p. 012089). IOP Publishing. https://doi.org/10.1088/1757-899X/407/1/012089

Archuleta, KL, Dale, A., & Spann, SM (2013). College students and financial distress: Exploring debt, financial satisfaction, and financial anxiety. Journal of Financial Counseling and Planning, 24(2), 50-62.https://doi.org/10.1037/t13109-000

Atkinson, A., & Messy, FA (2012). Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study.https://doi.org/10.1787/20797117

Central Bureau of Statistics (BPS). (2020, 2021). Statistical Official News.https://www.bps.go.id/pressrelease.html[Accessed January 03, 2021].

Baker, HK, & Nofsinger, JR (Eds.). (2010). Behavioral finance: investors, corporations, and markets (Vol. 6), Canada: John Wiley & Sons.

Barrafrem, K., Västfjäll, D., & Tinghög, G. (2020). Financial well-being, COVID-19, and the financial better-than-average-effect. Journal of Behavioral and Experimental Finance, 28, 100410.https://doi.org/10.1016/j.jbef.2020.100410

Basmar, E., & Hasdiana, S. (2021). Financial Literacy During the Covid 19 Pandemic (FLC19) and Its Impact on the Financial Cycle in Indonesia. POINT: Journal of Economics and Management, 3(2), 21-33.https://doi.org/10.46918/point.v3i2.1152

Botha, F., de New, JP, de New, SC, Ribar, DC, & Salamanca, N. (2021). Implications of COVID-19 labor market shocks for inequality in financial wellbeing. Journal of population economics, 34(2), 655-689.https://doi.org/10.1007/s00148-020-00821-2

Brüggen, EC, Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of business research, 79, 228-237.https://doi.org/10.1016/j.jbusres.2017.03.013

Capuano, A., & Ramsay, I. (2011). What causes suboptimal financial behavior? An exploration of financial literacy, social influences and behavioral economics. An Exploration of Financial Literacy, Social Influences and Behavioral Economics (March 23, 2011). U of Melbourne Legal Studies Research Paper, (540).http://dx.doi.org/10.2139/ssrn.1793502

Chen, H. and Volpe, RP (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107-128.https://doi.org/10.1016/S1057-0810(99)80006-7

Clark, R., Lusardi, A., & Mitchell, OS (2017). Employee financial literacy and retirement plan behavior: a case study. Economic Inquiry, 55(1), 248-259.https://doi.org/10.1111/ecin.12389

Comerton-Forde, C., Ip, E., Ribar, DC, Ross, J., Salamanca, N., & Tpreparlias, S. (2018). Using survey and banking data to measure financial wellbeing. Commonwealth Bank of Australia and Melbourne Institute Financial Well-being Scales Technical Report, 1.

Copur, Z., & Gutter, MS (2019). Economic, sociological, and psychological factors of the saving behavior: Turkey case. Journal of Family and Economic Issues, 40, 305-322.https://doi.org/10.1007/s10834-018-09606-y

Delafrooz, N., & Paim, LH (2011). Determinants of financial wellness among Malaysian workers. African Journal of Business Management, 5(24), 10092.https://di.org/10.5897/AJBM10.1267

Dewi, SN, Halawa, MH, & Nifanngelyau, L. (2021). The impact of Covid-19 on the property business. Journal of Economic Education (JPE), 1(1), 20-25.https://doi.org/10.30598/jpe.v1.i1.p20-25

Fachrudin, KA, & Silalahi, AS (2022). The Relationship among Financial Literacy, Conscientiousness Traits, Financial Behavior, and Financial Wellbeing. ITALIENISCH, 12(1), 765-776. Retrieved fromhttps://www.italienisch.nl/index.php/VerlagSauerlander/article/view/250

Falahati, L., Sabri, MF, and Paim, LH (2012). Assessment of a model of financial satisfaction predictors: examining the mediate effect of financial behavior and financial strain. World Applied Sciences Journal, 20(2), 190-197.https://10.5829/idosi.wasj.2012.20.02.1832

Florin, M., Pinar, U., Chavigny, E., Bouaboula, M., Jarboui, L., Coulibaly, A., ... & Fournier, L. (2020). Socio-economic and psychological impact of the COVID-19 outbreak on private practice and public hospital radiologists. European journal of radiology, 132, 109285.https://doi.org/10.1016/j.ejrad.2020.109285

Garðarsdóttir, RB, & Dittmar, H. (2012). The relationship of materialism to debt and financial well-being: The case of Iceland's perceived prosperity. Journal of economic psychology, 33(3), 471-481.https://doi.org/10.1016/j.joep.2011.12.008

Goleman, D. (1998). The emotionally competent leader. In The Healthcare Forum Journal, 41(2), 36-38. Available at:https://europepmc.org/article/med/10177113

Hadiwardoyo, W. (2020). National economic losses due to the Covid-19 pandemic. Baskara: Journal of Business and Entrepreneurship, 2(2), 83-92.https://doi.org/10.54268/baskara.2.2.83-92

Hair Jr., JF, Sarstedt, M., Ringle, CM, & Gudergan, SP (2017). Advanced issues in partial least squares structural equation modeling. sage publications.

Hayhoe, CR, & Gutter, ME (2012). Reliability of the scales in the NC1172 complex nature of saving data sets. Family and Consumer Sciences Research Journal, 40(3), 284-294.https://doi.org/10.1111/j.1552-3934.2011.02111.x

Hira, TK, & Mugenda, O. (1999). Do men and women differ in their financial beliefs and behaviors. Proceedings of eastern family economics resource management association, 1999, 1-8.

Hirvonen, J. 2018. Financial Behavior and Well-Being of Young Adults: Effects of Self-control and Optimism, Master's Thesis, School of Business and Economics, University of Jyväskylä.http://urn.fi/URN:NBN:fi:jyu-201810224480

Housel, M. (2020). The Psychology of Money: Timeless Lessons on Wealth. Greed, and Happiness, Hampshire, UK: Harriman House Limited.

Izzati, RA (2021). Poverty Situation During a Pandemic. Retrieved from SMERU Research Institute website:https://smeru.or.id/en/content/situasi-kemiskinan-selama-pandemi[Accessed January 01, 2022].

Jeevitha, P., & Priya, RK (2019). A study on saving and spending habits of college students with reference to Coimbatore city. International Journal of Research and Analytical Reviews, 6(1), 463-466. Available at:http://ijrar.com/upload_issue/ijrar_issue_20543376.pdf

Joo, SH, and Grable, JE (2004). An Exploratory Framework of the Determinants of Financial Satisfaction. Journal of family and economic Issues, 25(1): 25-50.https://doi.org/10.1023/B:JEEI.0000016722.37994.9f

Kalra Sahi, S. (2013). Demographic and socio-economic determinants of financial satisfaction: A study of SEC-A segment of individual investors in India. International Journal of Social Economics, 40(2), 127-150.https://doi.org/10.1108/03068291311283607

Kempson, E., Finney, A., & Poppe, C. (2017). Financial Well-Being. Retrieved from Open Digital Archive website:https://hdl.handle.net/20.500.12199/5968[Accessed January 01, 2022].

LaBorde, PM, Mottner, S., and Whalley, P. (2013). Personal financial literacy: Perceptions of knowledge, actual knowledge and behavior of college students. Journal of Financial Education, 39(3/4): 1-30. Available at:https://www.jstor.org/stable/23608645.

Lee, YG, & Dustin, L. (2021). Explaining financial satisfaction in marriage: The role of financial stress, financial knowledge, and financial behavior. Marriage & Family Review, 57(5), 397-421.https://doi.org/10.1080/01494929.2020.1865229

Lestari, D. (2020). Smart personal financial management manage finances. Yogyakarta: Deepublish Publisher.

Lind, T., Ahmed, A., Skagerlund, K., Strömbäck, C., Västfjäll, D., & Tinghög, G. (2020). Competence, confidence, and gender: The role of objective and subjective financial knowledge in household finance. Journal of Family and Economic Issues, 41, 626-638.https://doi.org/10.1007/s10834-020-09678-9

Loibl, C., Kraybill, DS, & DeMay, SW (2011). Accounting for the role of habit in regular saving. Journal of Economic Psychology, 32(4), 581-592.https://doi.org/10.1016/j.joep.2011.04.004

Loix, E., Peppermans, R., Mentens, C., Goedee, M., and Jegers, M. 2005. Orientation Toward Finances: Development of a Measurement Scale. The Journal of Behavioral Finance, 6(4): 192-201.https://doi.org/10.1207/s15427579jpfm0604_3.

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1-8.https://doi.org/10.1186/s41937-019-0027-5

Lusardi, A., & Mitchell, OS (2014). The economic importance of financial literacy: Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5-44.https://doi.org/10.1257/jel.52.1.5

Mahendru, M. (2021). Financial well-being for a sustainable society: a road less traveled. Qualitative Research in Organizations and Management: An International Journal, 16(3/4), 572-593.https://doi.org/10.1108/QROM-03-2020-1910

Malone, K., Stewart, SD, Wilson, J., & Korsching, PF (2010). Perceptions of financial well-being among American women in diverse families. Journal of Family and Economic Issues, 31, 63-81.https://doi.org/10.1007/s10834-009-9176-5

Marzuki I., Erniati B., Fitria Z., Agung MVP, Hesti K., Deasy HP, Dina C., Jamaludin, Bonaraja P., Ratna P., Muhammad C., Edwin B., Efendi S., Abdul RS , Nasrullah, Puji H., Faizah M., Sukarman P., Muhammad FR, Eka A., (2021), Covid-19 One Thousand and One Faces. The We Write Foundation, Medan, pp 107-126. Retrieved from We Write website:https://kitamenulis.id/2021/02/05/Covid-19-seribu-satu-muka/[Accessed January 01, 2022].

Maslow, AH 1943,“A theory of human motivation”,Psychological Review, Vol. 50No. 4, p. 370

Maslow, AH 1958,“A dynamic theory of human motivation”, in Stacey, CL and DeMartino, M. (Eds),Understanding Human Motivation, HowardAllen, pp. 26-47.

Memarista, G., Kristyanto, VS, & Kristina, N. (2022). What drives Indonesian financial satisfaction in the pandemic?. Maranatha Journal of Management, 21(2), 155-164.https://doi.org/10.28932/jmm.v21i2.4645

Mureșan, GM, Fülöp, MT, & Ciumaș, C. (2021). The road from money to happiness. Journal of Risk and Financial Management, 14(10), 459.https://doi.org/10.3390/jrfm14100459

Newman, C., Delaney, L., & Nolan, B. (2008). A Dynamic Model of the Relationship Between Income and Financial Satisfaction: Evidence from Ireland. Economic & Social Review, 39(2). Available at:https://ideas.repec.org/a/eso/journl/v39y2008i2p105-130.html

Noctor, M., Stoney, S. and Stradling, R. (1992). Financial Literacy: A Discussion of Concepts and Competences of Financial Literacy and Opportunities for its Introduction into Young People's Learning, Report prepared for the National Westminster Bank, National Foundation for Education Research, London.

Onder, S. (2006). A survey of awareness and behavior in regard to environmental issues among selcuk university students in Konya, Turkey. Journal of Applied Sciences, 6(2), 347-352. https://doi.org/10.3923/jas.2006.347.352

Oquaye, M., Owusu, GMY, & Bokpin, GA (2022). The antecedents and consequences of financial well-being: a survey of parliamentarians in Ghana. Review of Behavioral Finance, 14(1), 68-90.https://doi.org/10.1108/RBF-12-2019-0169

Financial Services Authority (OJK). (2020). 2019 National Financial Literacy and Inclusion Survey. Retrieved from website:https://ojk.go.id/id/berita-dan-activity/publikasi/Pages/[Accessed January 01, 2022].

Ouachani S, Belhassine O, & Kammoun, A. (2021). Measuring financial literacy: A literature review. Managerial Finance, 47(2), 266-281.https://doi.org/10.1108/MF-04-2019-0175

Owusu, GMY (2021). Predictors of financial satisfaction and its impact on the psychological well-being of individuals. Journal of Humanities and Applied Social Sciences, (ahead-of-print).https://doi.org/10.1108/JHASS-05-2021-0101

Panayiotou, G., Panteli, M., & Leonidou, C. (2021). Coping with the invisible enemy: The role of emotion regulation and awareness in quality of life during the COVID-19 pandemic. Journal of Contextual Behavioral Science, 19, 17-27.https://doi.org/10.1016/j.jcbs.2020.11.002

Pham, VK, Do Thi, TH, & Ha Le, TH (2020). A study on the COVID-19 awareness affecting the consumer perceived benefits of online shopping in Vietnam. Cogent Business & Management, 7(1), 1846882.https://doi.org/10.1080/23311975.2020.1846882

Rahman, M., Isa, CR, Masud, MM, Sarker, M., & Chowdhury, NT (2021). The role of financial behavior, financial literacy, and financial stress in explaining the financial well-being of the B40 group in Malaysia. Future Business Journal, 7(1), 1-18.https://doi.org/10.1186/s43093-021-00099-0

Ricciardi, V., & Simon, HK (2000). What is behavioral finance?. Business, Education & Technology Journal, 2(2), 1-9. Available at SSRN:https://ssrn.com/abstract=256754

Riitsalu, L. and Murakas, R. 2019. Subjective Financial Knowledge, Prudent Behavior and Income: The Predictors of Financial Well-Being in Estonia, International Journal of Bank Marketing 37 (4): 934-950.https://doi.org/10.1108/IJBM-03-2018-0071

Ristanto, A. (2022). Food Security and Subjective Welfare. Retrieved Ministry of Finance website:https://opini.kemenkeu.go.id/article/read/ [Accessed January 10, 2022].

Robb, CA, and Woodyard, A. 2011. Financial Knowledge and Best Practice Behavior. Journal of financial counseling and planning, 22(1). Available at SSRN:https://ssrn.com/abstract=2061308.

Rogers, EM (1974). Communication in development. The annals of the American academy of political and social science, 412(1), 44-54.https://doi.org/10.1177/0002716274412001

Sabri, MF, & MacDonald, M. (2010). Savings behavior and financial problems among college students: The role of financial literacy in Malaysia. Cross-Cultural Communication, 6(3), 103-110. Available at:www.cscanada.org

Sabri, MF, and Falahati, L. 2013. Predictors of Financial Well-Being among Malaysian Employees: Examining the Mediate Effect of Financial Stress. Journal of Emerging Economies and Islamic Research, 1(3): 1-16. Available at:https://ir.uitm.edu.my/id/eprint/32770.

Sadiq, MN, Khan, RAA, & Bashir, MK (2018). Individuals demographic differences and financial satisfaction: Evidence from Pakistan. buses. Econ. J, 9(3).https://doi/org/10.4172/2151-6219.1000369

Santrock, JW (2012). Life-Span Development. United Kingdom: McGraw-Hill Education.

Saurabh, K., & Nandan, T. (2018). Role of financial risk attitude and financial behavior as mediators in financial satisfaction: Empirical evidence from India. South Asian Journal of Business Studies, 7(2), 207-224.https://doi.org/10.1108/SAJBS-07-2017-0088

Savage, MJ, James, R., Magistro, D., Donaldson, J., Healy, LC, Nevill, M., & Hennis, PJ (2020). Mental health and movement behavior during the COVID-19 pandemic in UK university students: Prospective cohort study. Mental Health and Physical Activity, 19, 100357.https://doi.org/10.1016/j.mhpa.2020.100357

Now, U. & Bougie, RJ, (2016). Research Methods for Business: A skills Building Approach. 7th Edition, John Wiley & Sons Inc. New York, US.

Setiawan, M., Effendi, N., Santoso, T., Dewi, VI, & Sapulette, MS (2022). Digital financial literacy, current behavior of saving and spending and its future foresight. Economics of Innovation and New Technology, 31(4), 320-338.https://doi.org/10.1080/10438599.2020.1799142

Sherlyani, M., & Pamungkas, USA (2020). Effect of financial behavior, risk tolerance, and financial strain on financial satisfaction. Journal of Managerial and Entrepreneurship, 2(1), 272-281.https://doi.org/10.24912/jmk.v2i1.7468

Shim, S., Serido, J., & Tang, C. (2012). The ant and the grasshopper revisited: The present psychological benefits of saving and future oriented financial behaviors. Journal of Economic Psychology, 33(1), 155-165.https://doi.org/10.1016/j.joep.2011.08.005

Shim, S., Xiao, JJ, Barber, BI, and Lyons, AC (2009). Journal of Applied Development Psychology Pathways to Life Success: a Conceptual Model of Financial Well-Being for Young Adults, Journal of Applied Development Psychology, 30 (6): 708-723.https://doi.org/10.1016/j.appdev.2009.02.003.

Siallagan, D. (2020). Analysis of Inflation, GRDP, and Minimum Wage Effects on Labor Absorption in Pekanbaru City (Doctoral dissertation, Islamic University of Riau).

Singh, V., & Verma, S. (2023). Impact of COVID-19 awareness and technological anxiety on “mandatory telework”: a Danish case study. Information Technology & People, 36(5), 1790-1809.https://doi.org/10.1108/ITP-12-2020-0841

Strömbäck, C., Skagerlund, K., Västfjäll, D., & Tinghög, G. (2020). Subjective self-control but not objective measures of executive functions predict financial behavior and well-being. Journal of Behavioral and Experimental Finance, 27, 100339. https://doi.org/10.1016/j.jbef.2020.100339

Suryahadi, A., Al Izzati, R., & Suryadarma, D. (2020). The impact of the COVID-19 outbreak on poverty: An estimation for Indonesia. Jakarta: The SMERU Research Institute, 12, 3-4. Retrieved from SMERU Research Institute website:https://smeru.or.id/i [Accessed January 01, 2022].

Talwar, M., Talwar, S., Kaur, P., Tripathy, N., & Dhir, A. (2021). Has financial attitude impacted the trading activity of retail investors during the COVID-19 pandemic?. Journal of Retailing and Consumer Services, 58, 102341.https://doi.org/10.1016/j.jretconser.2020.102341

Van Praag, BM, Romanov, D., & Ferrer-i-Carbonell, A. (2010). Happiness and financial satisfaction in Israel: Effects of religiosity, ethnicity, and war. Journal of Economic Psychology, 31(6), 1008-1020.https://doi.org/10.1016/j.joep.2010.08.008

Vera-Toscano, E., Ateca-Amestoy, V., & Serrano-Del-Rosal, R. (2006). Building financial satisfaction. Social Indicators Research, 77(2), 211-243.https://doi.org/10.1007/s11205-005-2614-3

Walson, CO, & Fitzsimmons, VS (1993). Financial manager's perception of rural household Economy Well-Being: Development and testing of a composite measure. Journal of Family and Economic Issues, 14, 193-214.https://doi.org/10.1007/BF01022177

Widyastuti, U., Suhud, U., & Sumiati, A. (2016). The impact of financial literacy on student teachers' saving intention and saving behavior. Mediterranean Journal of Social Sciences, 7(6), 41. https://doi.org/10.5901/mjss.2016.v7n6p41

World Happiness Index (2021 December 01). Happiness Index: Country Rankings. Retrieved website:https://www.theglobaleconomy.com/rankings/happiness/ [Accessed December 01, 2021].

World meter (2021 December 01). COVID-19: Coronavirus Pandemic. Retrieved website:https://www.worldometers.info/coronavirus/ [Accessed December 01, 2021].

Xiao, JJ, & Kim, KT (2022). The able worry more? Debt delinquency, financial capability, and financial stress. Journal of Family and Economic Issues, 43(1), 138-152.https://doi.org/10.1007/s10834-021-09767-3

Xiao, JJ, & O'Neill, B. (2018). Propensity to plan, financial capability, and financial satisfaction. International Journal of Consumer Studies, 42(5), 501-512.https://doi.org/10.1111/ijcs.12461

Xiao, JJ, Chen, C., and Chen, F. (2014). Consumer Financial Capability and Financial Satisfaction. Social indicators research, 118(1): 415-432.https://doi.org/10.1007/s11205-013-0414-8.

Xiao, JJ 2008. Applying Behavior Theories to Financial Behavior: Handbook of Consumer Finance Research. Springers, New York

Yuesti, A., Rustiarini, NW, & Suryandari, NNA (2020). Financial literacy in the COVID-19 pandemic: pressure conditions in Indonesia. Entrepreneurship and Sustainability Issues, 8(1), 884-898.http://eprints.unmas.ac.id/id/eprint/1065

Zajacova, A., Jehn, A., Stackhouse, M., Denice, P., & Ramos, H. (2020). Changes in health behaviors during early COVID-19 and socio-demographic disparities: a cross-sectional analysis. Canadian Journal of Public Health, 111, 953-962.https://doi.org/10.17269/s41997-020-00434-y

Zemtsov, AA, & Osipova, TY (2016). Financial Wellbeing as a Type of Human Wellbeing: Theoretical Review. In F. Casati (Ed.), Lifelong Wellbeing in the World - WELLSO 2015, vol 7. European Proceedings of Social and Behavioral Sciences (pp. 385-392). Future Academy. https://doi.org/10.15405/epsbs.2016.02.49