Full Length Research Article - (2023) Volume 18, Issue 5

Integration Between An Organizations Enterprise Resource Planning Erp System And Business Process Reengineering Finance

Raghad Chichan Abd Ali1* and Soulef Smaoui2*Correspondence: Raghad Chichan Abd Ali, Institute of Higher Commercial Studies of Sousse, Tunisia, Email:

Abstract

Accounting seeks to keep up with the massive developments in other sciences and technological advancements. Therefore, accounting has adopted prevailing concepts in those sciences to serve the activities of economic units, including the concepts of economic intelligence and re-engineering. This approach is used to restructure and develop the accounting information system in line with the advancements in information technology and the knowledge era. Consequently, this research aims to explain the stages of re-engineering accounting information systems in economic units and the problems they face in order to facilitate the implementation of advanced information systems, including economic intelligence. Economic units are now more than ever required to establish an integrated system that includes technologies and human skills, ensuring access to accurate information at the right time, enabling them to choose the appropriate strategies to enhance their competitive advantage against competing economic units. To achieve these objectives, the theoretical aspect of the research employed frameworks, theoretical concepts, and researchers' perspectives in defining the concept and stages of business process re-engineering in economic units, as well as how to apply them to accounting information systems and the concept of economic intelligence, and the experiences of countries in this field, and the requirements that must be met for their implementation in economic units. Meanwhile, the practical aspect of the research relied on a case study of a vegetable oil company, where the company's current situation was analyzed to identify the problems, it faces and determine the extent to which the requirements for implementing economic intelligence are available, as well as the reasons for re-engineering its accounting information systems.

Keywords

Enterprise resource. Financial intelligence. Re-engineering.

Introduction

To address the competitive challenges in the business environment and the growing strategic role of economic intelligence systems in supporting financial operations, several contemporary studies have shown significant interest in Enterprise Resource Planning (ERP) system. This is due to the rapid and successive developments in information technology and economic intelligence and their widespread adoption. It is necessary to recognize the strong relationship between ERP system, on one hand, and Business Process Re-engineering for Financial (BPRF) on the other hand, as one of the sciences benefiting from advancements in economic intelligence technology (Alwan et al., 2023; Flayyih & Khiari, 2023). ERP systems and BPRF are complementary systems that can be used to improve the efficiency and effectiveness of financial operations. The integration of ERP systems and BPRF can lead to a number of benefits, including improved data accuracy, faster financial reporting, and better decision-making. There are a number of challenges that can be faced when integrating ERP systems and BPRF, such as data integration, system compatibility, and user resistance (M. A. Ali et al., 2023; Alyaseri et al., 2023; Salman et al., 2023). With the information revolution and the significant progress in information technology, it has had a significant impact on the performance of economic units and their ability to achieve their goals. In light of these recent developments, economic intelligence is considered a form of good economic sense. In order for economic units to innovate, produce, market, and compete, they need certain, comprehensive, and exploitable information. Therefore, the analysis and organization of information have become more important. In a highly competitive world where economic units need new and fast means to obtain information, they find themselves in urgent need of adopting economic intelligence in their strategies in order to strengthen their control in a constantly competitive market. The effects of Information Technology (IT) include the ability to produce a wide range of products. Moreover, the rapid rate of change in technology, coupled with the short product life cycle and market competition, has necessitated that companies take advantage of tools such as Enterprise Resource Planning (ERP) systems and strategic alliances as supply chains. These tools help unify cost reduction efforts and achieve cost differentiation strategies, ensuring their continuity in these markets.

There is a weakness in financial information systems and their failure to keep up with the rapid advancement in information technology. Therefore, there is a need for a comprehensive information system that provides decisionmakers with the information they need, whether it is about the internal or external environment. One of the most important of these comprehensive systems is economic intelligence, which is considered part of modern information systems. To implement this system, several requirements need to be met, including re-engineering financial processes to align with information technology advancements, and integrating it with Enterprise Resource Planning (ERP) systems. The foundation of implementing economic intelligence lies in these prerequisites.

The researcher believes that one of the main advantages of economic intelligence is the increase in support for economic intelligence, such as Business Process Re-engineering for Financial (BPRF) and the Enterprise Resource Planning (ERP) system. The researcher sees integrating the BPRF and ERP systems as a way to reduce data processing costs and manual procedures. This integration will also reduce labor costs and increase the flow of information across subsidiary company units, resulting in more accurate information and reducing supply and wait times. As a result, there will be greater accuracy and quality in the organization's resource planning process, leading to better utilization of its resources despite their scarcity.

This study aims to analyze the potential benefits that integration between ERP systems and BPRF can bring to an organization's financial processes. and identify the challenges and barriers that may arise during the integration process. Also, examine the techniques and strategies that can be employed to successfully integrate ERP systems and BPRF. and finally assess the impact of integrated ERP and BPRF systems on financial intelligence within an organization.

Literature Review

Article of (Koch, 2001) analyses enterprise resource planning (ERP) as a tool for realising business process reengineering (BPR) in manufacturing. It combines theories from organisational sociology and management with technologyanalysis. Change is viewed as involving choice and coalition building. The case studies cover 30 implementations of ERP with different types of change. Two cases of the variant labelled “BPR followed by ERP” are focused on. The change proceeds as a co‐operation between enterprises, consultants and ITsuppliers. In the first case, a superficial management change programmed of BPR and ERP emerges into a more elaborate change program, which was then relatively successfully realised. The other case is a multi‐front exercise for the management coalition. The BPR strategy was poorly supported and restated the long-term split between manufacturing and sales. The two cases exhibit different experiences, but they underpin that process integration cannot be taken for granted when implementing BPR and ERP.

The paper of (Chou et al., 2005) seeks to propose a business intelligence (BI) and enterprise resource planning (ERP) integrated framework that adds value to enterprise systems. Design/methodology/approach–A conceptual approach is taken. Findings–ERP systems integrate all facets of the business and make data available in real time. BI tools are capable of accessing data directly from ERP modules. Originality/value–The value-added system proposed allows enterprise‐wide transaction data to be collected and analyzed for organizational decision-making processes.

(Rasmy et al., 2005) finds in their study that Enterprise Informa ionization is an efficient way to improve enterprise economic efforts and its competency, while to carry out integration of ERP with BPR is important in enterprise Informa ionization. It can improve enterprise resource's efficiency and account for ERP's applicative problems. The integrative course of ERP and BPR includes three critical problems: concept re-engineering, process reengineering and organization structure re-engineering. In the integration, concept re-engineering is the hypothesis, process re-engineering is the core and organization structure re-engineering is the important content.

The paper of (Subramoniam et al., 2009) presents some sample ERP installations to come out with various types of business BPR, ranging from small‐r to big‐R, practiced while implementing ERP. They found that, it could be found that all organizations implementing ERP have chosen their own approach based on organizational constraints and the needs. The importance of BPR in ERP implementation is highlighted in earlier studies.

In (Chen et al., 2013) paper, a framework for integration ERP system into BPM system is proposed. The framework closes the gap between ERP system and BPM system, enables full life-cycle of process centric enterprise system implementation. As the researchers see that Business Process Management (BPM) is a structured approach to understand, analyze, support, and continuously improve fundamental process. In order to improve the success rate of ERP in project implementation, enterprises often implement BPM before or during the ERP implementation.

(Aldossari and Mukhtar, 2019) see that ERP and BI are complex and costly systems designed to automate processes across an organization. Successful ERP system usage requires re-platforming and hosting traditional models. ERPBI application is a strategic investment that can provide a competitive advantage and positive return. However, there is no specific model for ERPBI adoption, leading to improper use and adoption. This study aims to identify factors influencing behavioral intention towards ERPBI adoption in the private sector of the Kingdom of Saudi Arabia.

The purpose of the study (Zafary, 2020) was to discuss the importance of ERP and BI and Integration of ERP and BI. ERP involves the planning and managing of the organization's resources in the most efficient, productive and pro table manner. Also, business intelligence is a key means to promote core competence of enterprise. Business intelligence is a set of technologies that facilitate the collection, integration and analysis of data within a rm, thus enabling the decision-making process. The system of ERP and BI integrated can enhance and improve the ability of companies to decision-making.

Theoretical farmwork

1. Financial process re-engineering (BPRF)

The concept of business process re-engineering (BPR) is one of the latest change management concepts that has revolutionized the modern world. It represents a bold call to reassess everything an organization is accustomed to doing in terms of its tasks, studies, evaluations, and radical restructuring. In other words, it is a complete abandonment of old customer procedures and a new way of thinking that helps in facing sudden and radical changes. (Turban et al, 1998) defines re-engineering as part of the innovation process that involves going back to the process to examine the overall objectives of the organization and then introducing innovative and effective changes to achieve significant improvements. This includes exploring new strategies for work and actual activities, designing processes, and investing in all its complex dimensions, including technology, human, and organizational aspects (Law, 2019). (Russell & Taylor) also define re-engineering that focuses on outcomes in order to obtain new facilities, products, and new customers. They define re-engineering as a comprehensive redesign of the process to obtain new facilities, products, new technology, and understanding the expectations of new customers, with the continuous design of processes. (Russell & Taylor, 2000: 240)

Mark M. Davis emphasizes that re-engineering focuses on processes rather than individual performance or tasks. Its main element is the concept of disruptive thinking and the abandonment of rules and assumptions on which current business operations are based. (Davis, 2013:171).

Some researchers have shown that there are motivations that urge economic units to re-engineer their businesses. Re-engineering can apply to units that are facing problems such as:

• Rising operational costs.

• Reduction in the quality of products and services provided to customers.

• A high level of "operational bottlenecks" in peak seasons.

• Weak performance of middle-level managers.

• Misallocation of resources and functions in order to maximize performance, etc.

The crisis of successive competition faced by economic units had a profound impact on the emergence of three forces called (3Cs), which are represented by:

a. Customers: Customers are the most important force in the business environment. They are the ones who ultimately determine the success or failure of a business. Businesses need to understand their customers' needs and wants in order to provide them with products and services that they value.

b. Competitors: Competitors are businesses that offer similar products and services to a business. They are a major force in the business environment because they can drive down prices, improve quality, and introduce new products and services. Businesses need to be aware of their competitors' strengths and weaknesses in order to compete effectively.

c. Change: Change is a constant in the business environment.Businesses need to be able to adapt to change in order to survive and thrive. Change can come from a variety of sources, such as new technology, new regulations, and new customer preferences. Businesses need to be prepared for change and have a plan in place to deal with it.

2. Objectives of process re-engineeringTao, (2019) argues that scientifically and soundly re-engineering processes will enable a facility to achieve the following objectives, which are the purpose of process re-engineering in facilities:

• Achieving radical change in performance: The efforts of process re-engineering aim to achieve a radical change in performance, which is embodied in changing the method, tools, and outcomes by enabling workers to design and perform the work according to the needs of customers and the goals of the facility.

• Customer focus: Process re-engineering aims to guide the facility to focus on customers by identifying their needs and working towards fulfilling their desires, thus the processes are rebuilt to achieve this purpose.

• Speed in performance: Here, process re-engineering aims to enable the facility to perform its work at a high speed by providing the required information to decide and facilitating the process of obtaining it.

• Quality: Process re-engineering aims to improve the services and products provided to match the needs and desires of customers.

• Cost reduction: Process re-engineering aims to reduce costs by eliminating unnecessary processes and focusing on value-added processes.

(Zomparelli, 2018: 1654) added that process re-engineering has achieved significant success by the facilities that have implemented it in addressing their problems and enhancing their competitiveness. One of the most important objectives of re-engineering are Increasing productivity: By achieving workflow, rather than through fragmented organizational structures, Maximizing the return on assets: By implementing tasks in innovative ways and increasing their effectiveness and Achieving high results: In order for a facility to be considered a 21st century facility, the increase in results should be at least 50%, otherwise it will be considered a 20th century facility, even if its results are advanced.

3. Economic intelligence

The rapid economic changes occurring worldwide, as well as the financial crises that economic units have faced, in addition to the advancements in information technology, have all posed challenges to these units (Hadi, Abdulhameed, et al., 2023). These challenges have forced them to work towards pursuing the competitive market and distinguishing themselves from their peers. In order to achieve this and make informed decisions to face competitors, it was necessary to have a comprehensive information system. The production of information has become an important matter that units are concerned with, given the developments and expansion of the competitive environment. The purpose is to connect external events with internal ones and analyze them to reach strategic information. In order to achieve this and make sound decisions, units have adopted the concept of economic intelligence to produce information (Hasan et al., 2023). The concept of economic intelligence is closely related to the efficient allocation of resources and the ability to adapt and innovate in response to changing economic conditions. It is about gathering, analyzing, and utilizing economic data and information to gain insights and make informed decisions. This includes understanding market trends, consumer behavior, industry dynamics, and competitor activities (Lebbou, 2014). Economic intelligence can assist economic units in identifying potential opportunities and risks, optimizing resource allocation, developing effective strategies, and enhancing overall performance. It involves the use of various analytical tools and techniques, such as statistical analysis, financial modeling, and forecasting, to generate actionable insights and support decision-making processes (Abass et al., 2023; Hadi et al., 2023).

In summary, economic intelligence is a vital aspect of economic and financial management. It enables economic units to navigate the complexities of the economic landscape, adapt to changes, and make informed decisions that drive growth and success.

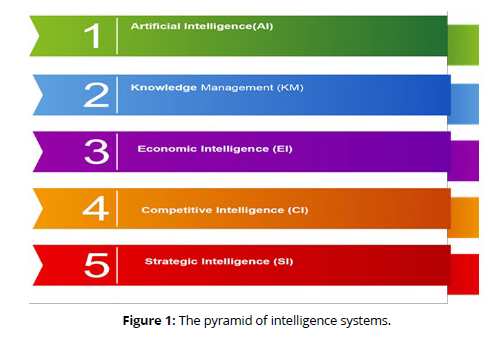

In the field of work, intelligence can allow managers to access opportunities for success and ensure the achievement of goals in a better way, by contributing to increasing profitability indicators and continuously developing and growing economic units. Intelligence also helps professionally strengthen decision-making processes and strategies (Ali et al., 2023; Hasan et al., 2023; Nikkeh et al., 2022; Saeed et al., 2022). Intelligence is considered an asset for management, as it gains the power of insight and achieving success. Studies and research have confirmed a strong relationship between the success of economic units and the managerial attributes and characteristics, with intelligence being one of the most important characteristics (Lebbou 2014). In the field of business, there are various forms of intelligence, including artificial intelligence, knowledge management, business intelligence, economic intelligence, competitive intelligence, and strategic intelligence (Arenas, 2014).(Figure 1)

Figure (1) illustrates the pyramid of intelligence systems, and there are those who confuse them and consider them as one concept with different names. There are differences between the intelligence systems mentioned above, and in the following paragraphs, we will try to explain these differences. But before we discuss the differences, we will first explain the concept of economic intelligence and its origin, as the research topic is related to it (Talab & Flayyih, 2023). The idea of economic intelligence emerged with the advent of trade, especially the emergence of market economies. Fernand Braudel, in several studies he conducted on the growing power of large trading cities from the 15th to the 18th centuries, explained that competition between cities in northern Italy and cities in Flanders marked the beginning of economic attacks, economic espionage, and even forgery (Tabbouche, 2011).

The concept of economic intelligence has been widely discussed and utilized in various fields and industries, including the military sector. In the colonial era, Britain obtained information about the Mediterranean Sea region and other areas through espionage in Venice (Berman, 2013). During World War II, economic intelligence played a significant role in the conflict with Germany. It was essential to gather detailed information about the German military equipment, plan for the timing and type of battle to be fought, and understand the strengths and weaknesses of the German industry (Ruggles & Brodie, 1947). In recent years, economic intelligence has gained even more prominence and has become a crucial element for economic units and organizations to thrive in today's competitive business environment. It involves gathering, analyzing, and interpreting data and information related to economic factors, such as market trends, consumer behavior, competitor strategies, and industry dynamics. Economic intelligence provides organizations with valuable insights and knowledge to make informed decisions, develop effective strategies, identify market opportunities, mitigate risks, and optimize resource allocation. It involves the use of various tools and techniques, including market research, data analysis, statistical modeling, and forecasting.

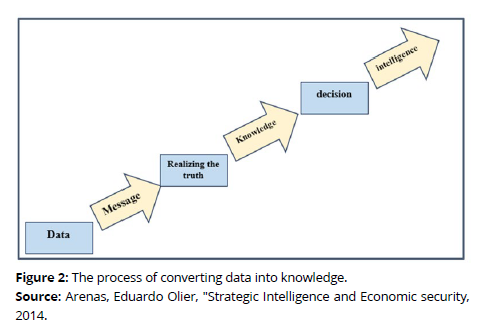

Overall, economic intelligence plays a vital role in supporting economic units in their decision-making processes and enabling them to adapt and thrive in a rapidly changing economic landscape. It helps them stay ahead of the competition, identify new business opportunities, and make sound strategic choices to achieve sustainable growth and success (Figure 2).

Source: Arenas, Eduardo Olier, "Strategic Intelligence and Economic security, 2014.

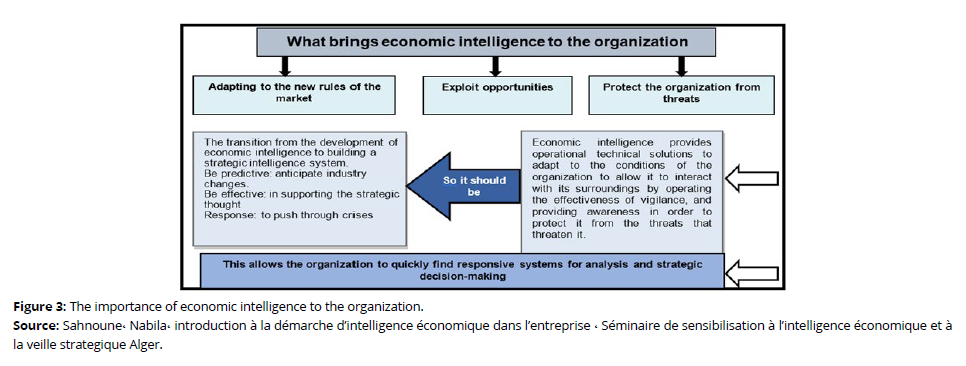

Economic intelligence can be defined as the process of researching, analyzing, disseminating, and enriching existing information resources based on an information system in an economic unit (Khalaflawi, 2012). Economic intelligence is closely linked to the information system of the unit and is considered a link between the unit and its external environment. There has been a close connection between economic intelligence and the unit's information system, and it has been considered as a link between the unit and its external environment (Khalaflawi, 2012) (Figure 3).

Source: Sahnoune، Nabila، introduction à la démarche d’intelligence économique dans l’entreprise ، Séminaire de sensibilisation à l’intelligence économique et à la veille strategique Alger.

Designing the study tool and discuss results:

In this study, the researcher will attempt to study two axes, namely Business Process Re-engineering of Financial Processes (BPRF), and Enterprise Resource Planning (ERP) system, through surveying the opinions of accountants, auditors, administrators at the OR Public Company for Engineering Industries, and academics.

In light of the study's variables and assumptions, in order to test the correlation between BPRF and ERP with the aim of applying economic intelligence, a questionnaire was designed to determine different opinions on the study's axes. The questionnaire went through several stages until it reached its final form, which includes:

1. Stage of preparing the questionnaire: This stage included obtaining some ideas and phrases from reviewing previous studies on the topic of the two axes and their impact on the application of economic intelligence, taking into account the development of some basic factors or characteristics of these axes. The professional parties in the surrounding environment, including accountants, auditors, administrators in UR General Company for Engineering Industries, and experts in the field were requested to express their opinions and assessments for each axis and its impact on the application of economic intelligence. The answer tests were formulated using a Likert scale with five points, and the response level for each statement was on a scale of 1 to 5, where the highest degree represents the highest level of agreement, and degree 1 indicates the lowest level of agreement, according to Table 1:

| classification | I completely agree | ↔ | I don't agree at all. | ||

|---|---|---|---|---|---|

| Grade | 5 | 4 | 3 | 2 | 1 |

Community and study sample

The study community consists of the targeted accountants, their number is (25), auditors, their number is (25), administrators in the OR General Company for Engineering Industries, their number is (25), specialized academics, their number is (25), who responded to the research. The study sample size reached 120 individuals, and the questionnaire was distributed to all sample members, and 106 questionnaires were retrieved. After examining the questionnaires, 6 questionnaires were excluded due to not meeting the required conditions. Thus, the number of questionnaires subject to the study is 100 questionnaires, as shown in Table 2.

| Sequencing Names | Accountants at your General Company for Engineering Industries | Auditors at your General Company for Engineering Industries | Administrators at your General Company for Engineering Industries | Academics with specializations | Total | |

|---|---|---|---|---|---|---|

| 1 | Sample | 25 | 25 | 30 | 40 | 120 |

| 2 | Response | 25 | 25 | 30 | 26 | 106 |

| 3 | Response Rate | 23.5 % | 23.4 % | 28.3 % | 24.5 % | 88.3 % |

From the previous table, it is clear that the response rate was (88.3%), which is considered appropriate and sufficient for analyzing the data in this type of study and consistent with previous field studies in this field.

Statistical methods:

The data analysis and results extraction process were conducted using appropriate statistical methods for the nature of the data, sample type, and study objectives, using a set of statistical software for social sciences. The researcher utilized percentage ratios, means, standard deviations, and correlation coefficients to test the degree of correlation between the variables.

The results of the statistical analysis of the data obtained from the questionnaire forms are as follows:

The correlation between Business Process Re-engineering of Financial Processes (BPRF) and the Enterprise Resource Planning (ERP) system with the aim of implementing economic intelligence.

The answers of the paragraphs of the third axis of the questionnaire reflect (the relationship between Business Process Re-engineering (BPRF) and Enterprise Resource Planning (ERP) systems with the aim of implementing economic intelligence). These answers obtained a mean score ranging between (3-3.9) and a standard deviation (1- 1.5), which indicates a good agreement on the answers. It can be observed from the answers to the first question of the third axis that the average mean of the answer's ranges between (3-3.6), thus the average mean of the sample answers is (3.3), which proves the agreement of the sample respondents, especially in the difference in the standard deviation of the answers as evident in table number (3), in accepting the first question. It can also be observed from the second question that the correct answer included a mean score ranging between (3.1-3.8), and thus the average mean of the sample answers is (3.4), which indicates a high agreement of the sample respondents in accepting the question, despite the difference in the standard deviation. It can be observed from the third question that the correct answer included a mean score ranging between (3.1-3.3), and the average mean of the sample answers is (3.1), which indicates the agreement of the research sample and the difference in the standard deviation of the answer. As for the fourth question, the answers have a mean score ranging between (3- 3.6), and the average mean of the sample answers is (3.4), which is agreed upon by the sample as it gives a correct and truthful view. It can be observed from the fifth question that the research sample agrees on the answers, with a mean score ranging between (3.1 -3.5), which gives an average mean of the sample answer (3.4), indicating a good agreement among the research sample answers. As for the sixth question, the mean score ranges between (3.1-3.4), and the average mean of the sample answers is (3.3), this mean indicates the agreement of the opinion among the sample respondents and the difference in the standard deviation for each mean, which are consecutive. It can be observed from the seventh question that the average mean of the answer's ranges between (3.3-3.8), and thus the average mean of the sample answer is (3.6), which is highly agreed upon by the sample respondents despite the difference in the standard deviation of the sample answers. The range of the average mean of the answers to the eighth question, as shown in the table, is between (3.5-3.8), and the average mean of the sample answers is (3.7), which indicates a high agreement among the sample respondents, especially with the difference in the standard deviation. It can be observed from the answers of the research sample to the ninth question that the mean score of the answer's ranges between (3.2-3.9), which gives the average mean of the sample answer (3.5), indicating that it gives a correct and truthful view of the risk. It can be observed from the tenth question that the mean score of the answer ranges between (3.1-3.4), which gives the average mean of the sample answer (3.2), providing an average indicator of the agreement of the sample opinion.

Correlation coefficientr

Table (3) displays the correlation coefficients between the three variables, indicating that the correlation coefficients shown are significant at a significance level of 0.05. The computed correlation coefficient (r) is greater than the critical value of 0.3. As a result, the statements regarding the axes are reliable for measurement (Table 3).

| Accountants at your General Company for Engineering Industries | |||

|---|---|---|---|

| Wonderful | R13 | R12 | |

| Correlation coefficient | 0.6 | 0.7 | 0.7 |

| Auditors at your General Company for Engineering Industries | |||

| Wonderful | R13 | R12 | |

| Correlation coefficient | 0.4 | 0.5 | 0.4 |

| Administrators at your General Company for Engineering Industries | |||

| Wonderful | R13 | R12 | |

| Correlation coefficient | 0.4 | 0.5 | 0.6 |

| Academics with specializations | |||

| Wonderful | R13 | R12 | |

| Correlation coefficient | 0.8 | 0.7 | 0.9 |

From Table (3), the first axis was assumed to be X1, the second axis as X2, and the third axis as X3. Therefore, the correlation coefficient between the three axes is considered good because the calculated value of r (-1 ≤ r ≤ 1) falls within this range. Referring to Table (3), we find that the correlation between the first and second axes is good (-1 ≤ r ≤ 1), as observed in all selected research samples. Similarly, there is a good correlation between the first and third axes, as well as the second and third axes.

Conclusion

Re-engineering is a method for radically changing the old methods used in economic units in order to improve performance. Re-engineering is not limited to deteriorating economic units, but also includes successful economic units. These units constantly seek to achieve further excellence and explore new methods to develop their operations in order to keep up with the rapid changes in the work environment. There are several methods for developing information systems, one of which is re-engineering. There should be compatibility between the infrastructure of information technology and the re-engineering strategy to ensure the success of the re-engineering program. Economic intelligence is an integrated information system that provides strategic information to users, and it can be applied at the national or economic unit level. One of the prerequisites for implementing economic intelligence is re-engineering the work environment, as intelligence requires the input of information technology and communications, as well as the improvement of workflows in economic units. The information system of the units represents an important resource for the units in the process of economic intelligence, as the components of the system represent the infrastructure of economic intelligence for the information it provides about the internal environment.

References

Abass, Z. K., Al-Abedi, T. K., & Flayyih, H. H. (2023). Integration Between Cobit And Coso For Internal Control And Its Reflection On Auditing Risk With Corporate Governance As The Mediating Variable. International Journal Of Economics And Finance Studies, 15(2), 40–58. https://doi.org/10.34109/ijefs.202315203

Aldossari, S., & Mukhtar, U. A. (2019). Enterprise Resource Planning And Business Intelligence To Enhance Organizational Performance In Private Sector Of Ksa: A Preliminary Review. In Recent Trends In Data Science And Soft Computing: Proceedings Of The 3rd International Conference Of Reliable Information And Communication Technology (Irict 2018) (Pp. 343-352). Springer International Publishing.

Ali, M. A., Hussin, N., Flayyih, H. H., Haddad, H., Al-Ramahi, N. M., Almubaydeen, T. H., Hussein, S. A., & Hasan Abunaila, A. S. (2023). A Multidimensional View Of Intellectual Capital And Dynamic Innovative Performance. Journal Of Risk And Financial Management, 16(3), 139. HTTPS://DOI.ORG/10.3390/JRFM16030139

Ali, S. I., Al-Taie, B. F. K., & Flayyih, H. H. (2023). The Effects Of Negative Audit And Audit Environment On The Internal Auditor Performance: Mediating Role Of Auditing Process Independence. International Journal Of Economics And Finance Studies, 15(1), 64–79. https://doi.org/10.34109/ijefs.202315105

Alwan, S. A., Jawad, K. K., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Aned, A. M., Sharaf, H. K., Flayyih, H. H., Salman, M. D., Abdulrasool, T. S., Abdulrasool, T. S., & Abed, R. A. (2023). The Psychological Effects Of Perfectionism On Sport, Economic And Engineering Students. Revista Iberoamericana De Psicologia Del Ejercicio Y El Deporte, 18(3), 330–333. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Alyaseri, N. H. A., Salman, M. D., Maseer, R. W., Hussein, E. K., Subhi, K. A., Alwan, S. A., Zwaid, J. G., Aned, A. M., Jawad, K. K., Flayyih, H. H., Sharaf, H. K., Bachache, N. K., & Abed, R. A. (2023). Exploring The Modeling Of Socio-Technical Systems In The Fields Of Sport, Engineering And Economics. Revista Iberoamericana De Psicología Del Ejercicio Y El Deporte, 18(3). HTTPS://DOI.ORG/10.34111/IJEFS

Arenas, E. O. (2014). Strategic Intelligence And Economic Security. Paper Presented At The Economic Intelligence In A Global World: Strategic Dossier.

Berman, K., Knight, J. And Case, J. (2013), Financial Intelligence, A Managers Guide To

Boucheloukh, M. F., "Intelligence Économique En Algérie", Cours De Master En Intelligence Économique, 2 Éme Promotion, Ufc, Alger, 2010, P : 28.

Chen, F., Wang, Q., Wei, Q., Ren, C., Shao, B., & Li, J. (2013, July). Integrate Erp System Into Business Process Management System. In Proceedings Of 2013 Ieee International Conference On Service Operations And Logistics, And Informatics (Pp. 436-439). Ieee.

Chou, D. C., Bindu Tripuramallu, H., & Chou, A. Y. (2005). Bi And Erp Integration. Information Management & Computer Security, 13(5), 340-349.

Cox, J. (2009). Intelligence: Definitions, Concepts And Governance: Parliamentary Information And Research Service, Library Of Parliament.

Direction Générale (2010)’Intelligence Economique, "Manuel De Formation En Intelligence Économique En Algérie", Document De Référence, Alger, Septembre.

Flayyih, H. H., & Khiari, W. (2023). Empirically Measuring The Impact Of Corporate Social Responsibility On Earnings Management In Listed Banks Of The Iraqi Stock Exchange: The Mediating Role Of Corporate Governance. Industrial Engineering And Management Systems, 22(3), 321–333. https://doi.org/10.7232/iems.2023.22.3.321

Hadi, A. H., Abdulhameed, G. R., Malik, Y. S., & Flayyih, H. H. (2023). The Influence Of Information Technology (It) On Firm Profitability And Stock Returns. Eastern-European Journal Of Enterprise Technologies, 4(13(124)), 87–93. https://doi.org/10.15587/1729-4061.2023.286212

Hadi, A. H., Ali, M. N., Al-Shiblawi, G. A. K., Flayyih, H. H., & Talab, H. R. (2023). The Effects Of Information Technology Adoption On The Financial Reporting: Moderating Role Of Audit Risk. International Journal Of Economics And Finance Studies, 15(1), 47–63. https://doi.org/10.34109/ijefs.202315104

Hafer, R.W, (2017) New Estimates On The Relationship Between Iq, Economic Growth And

Hasan, S. I., Saeed, H. S., Al-Abedi, T. K., & Flayyih, H. H. (2023). The Role Of Target Cost Management Approach In Reducing Costs For The Achievement Of Competitive Advantage As A Mediator: An Applied Study Of The Iraqi Electrical Industry. International Journal Of Economics And Finance Studies, 15(2), 214–230. https://doi.org/10.34109/ijefs.202315211

Julie P., Bryn S. And Irene G.(2013), Financial Intelligence A Guide To For Social Enterprise, Knowing What The Numbers Really Mean, 2nd Edition.

Koch, C. (2001). Bpr And Erp: Realising A Vision Of Process With It. Business Process Management Journal, 7(3), 258-265.

Law, C. F. T. P. A. (2019). Economic Intelligence And National Security: Mcgill-Queen's Press - Mqup.

Lebbou, M. L., (2014)"Intelligence Économique Et Stratégie De Développement Des Entreprises : Cas Des Pme Algériennes", Thèse De Doctorat En Sciences Économiques Et Sciences De Gestion, Filière : Sciences Économiques, Université Badji Mokhtar, Annaba, Algérie,

Nikkeh, N. S., Hasan, S. I., Saeed, H. S., & Flayyih, H. H. (2022). The Role Of Costing Techniques In Reduction Of Cost And Achieving Competitive Advantage In Iraqi Financial Institutions. International Journal Of Economics And Finance Studies, 14(4), 62–79. https://doi.org/10.34109/ijefs.20220104

Rasmy, M. H., Tharwat, A., & Ashraf, S. (2005, June). Enterprise Resource Planning (Erp) Implementation In The Egyptian Organizational Context. In Proceedings Of The Emcis International Conference (Pp. 1-13).

Saeed, H. S., Hasan, S. I., Nikkeh, N. S., & Flayyih, H. H. (2022). The Mediating Role Of Sustainable Development In The Relationship Between Producer Cost Expectations And Customer Desires. Journal Of Sustainability Science And Management, 17(10), 13–21.

Salman, M. D., Alwan, S. A., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Sharaf, H. K., Bachache, N. K., Jawad, K. K., Flayyih, H. H., Abed, R. A., Zwaid, J. G., & Abdulrasool, T. S. (2023). The Impact Of Engineering Anxiety On Students: A Comprehensive Study In The Fields Of Sport, Economics, And Teaching Methods. Revista Iberoamericana De Psicologia Del Ejercicio Y El Deporte, 18(3), 326–329. https://www.riped-online.com/archive/riped-volume-18-issue-3-year-2023.html

Subramoniam, S., Tounsi, M., & Krishnankutty, K. V. (2009). The Role Of Bpr In The Implementation Of Erp Systems. Business Process Management Journal, 15(5), 653-668.

Talab, H. R., & Flayyih, H. H. (2023). An Empirical Study To Measure The Impact Of Information Technology Governance Under The Control Objectives For Information And Related Technologies On Financial Performance | Um Estudo Empírico Para Medir O Impacto Da Governança De Tecnologia Da Informaçã. International Journal Of Professional Business Review, 8(4). https://doi.org/10.26668/businessreview/2023.v8i4.1382

Tao, Jin & Yu Ho,Chun & Luo, Shougui & Sheng, Yue,( 2019), Agglomeration Economies In Creative Industries, Regional Science And Urban Economics, Volume 77, Pp 141-154

Turban, E., Mclean, E., & Wetherbe, J. (1998). Information Technology For Management Making Connections For Strategic Advantage: John Wiley & Sons, Inc.

Zafary, F. (2020). Implementation Of Business Intelligence Considering The Role Of Information Systems Integration And Enterprise Resource Planning. Journal Of Intelligence Studies In Business, 1(1).

Zomparelli, F. & Petrillo, L. & Di Salvo, B. & Petrillo, A, 2018, Re- -10 Engineering And Relocation Of Manufacturing Process Through A Simulative And Multicriteria Decision Model Ifac-Papersonline, Volume 51, No 11, Pp 1649-1654.